An Offer You Can Refuse: A Host Country’s Strategic Allocation of Development Financing

Hydropower projects are one of the leading energy sectors being developed in Africa. In the past two decades, this demand has been increasingly met by Chinese financing and Chinese contractors, creating an impression that host countries have no choice but to accept Chinese advances against their preferences. This essay demonstrates through the case study of the Mount Coffee hydropower project in Liberia that host countries strategically allocate financing from different sources to different projects, based on domestic development needs, administrative capacity, flexibility of financiers, and institutional memory between the host and the financiers. This essay also shows that concerns over Chinese contractors’ environmental- and social-impact records reflect a combination of host enforcement, financier self-sorting, and Chinese contractors’ own perceptions of their comparative advantage. More broadly, this case study provides empirical observations of host countries’ agency and strategic calculus in the financier-host relation, as well as the limits of China’s role in Africa’s hydropower sector.

As numerous contributions to this issue of Dædalus make clear, it is impossible to disentangle questions of water security from questions of infrastructure. Indeed, it is the weakness of Africa’s infrastructure that explains, at least in part, the deep concerns over water scarcity and climate change. In 2009, the Africa Infrastructure Country Diagnostic project of the World Bank addressed the infrastructure gap, highlighting how water resource management crosscuts sanitation, agricultural production, and power supply:

Though water is vital for agriculture, only 5 percent of Africa’s cultivated land is irrigated. Hydropower is also largely undeveloped in Africa; less than 10 percent of its potential has been tapped. Water for people and animals is vital for health and livelihoods, yet only 58 percent of Africans have access to safe drinking water.1

Among these myriad challenges, the World Bank noted that “Power is by far Africa’s largest infrastructure challenge, with 30 countries facing regular power shortages and many paying high premiums for emergency power.” Approximately 40 percent of total infrastructure spending is associated with power, and about “one-third of power investment needs (some $9 billion a year) are associated with multipurpose water storage for hydropower and water resources management.” In view of the large demand for power-sector investments, and even if Africa’s domestic financing can capture potential efficiency gains, “Africa would still face an infrastructure funding gap of $31 billion a year, mainly in power.”2 A 2021 report shows that only 11 percent of the technically feasible hydropower potential has been developed in Africa.3

However, hydropower projects (HPP) are coming under increasing scrutiny because of their social and environmental impacts.4 As essays in this volume by Jennifer Derr, Allen Isaacman, and Harry Verhoeven highlight in the diverse contexts of Egypt, Ethiopia, and Mozambique, the cost-benefit ratios of HPPs are greatly skewed in favor of powerful, vested elites.5 Newly created reservoirs can increase the energy output of HPPs, but they flood large tracts of land to the detriment of the local ecology and populations. The impact of changing hydrology is not limited to the immediate areas around the project, but also affects distant upstream and downstream regions. Very large hydropower projects can even influence surrounding climate and precipitation patterns.6

Partially in response to these concerns, the World Bank has been retreating in recent decades from financing large HPPs.7 The World Commission on Dams (WCD), organized by the World Bank and the World Conservation Union between 1997 and 2001, argued that while there are developmental benefits from HPPs, in “too many cases an unacceptable and often unnecessary price has been paid to secure those benefits, especially in social and environmental terms, by people displaced, by communities downstream, by taxpayers and by the natural environment.”8 Among the recommendations provided by the WCD are: more stringent social and environmental evaluation, maximizing existing HPPs instead of building new ones, more inclusive participatory processes for all stakeholders involved, and taking a basin-wide approach to evaluating project feasibility in order to reduce both ecosystem impact and transboundary political conflicts. African countries were thus faced with the challenge of balancing new standards from financiers on top of existing development demands and funding constraints.

Just as the World Bank, the then leading development finance institution, was pulling back from large HPPs, China moved rapidly into Africa’s infrastructure sector and became a new source of credit. Between 2000 and 2019, the Export-Import Bank of China (China Eximbank), China’s export credit agency and primary source of Chinese official development financing in Africa, committed at least US$10 billion in loan financing to HPPs in Africa, spanning twenty-four projects in eighteen countries. This did not include their role in financing transmission lines that accompany HPPs, nor their role in consortium financing for mega HPPs, such as the US$4.1 billion Caculo Cabaça HPP in Angola, both of which increased their financing profile (see Table 1).

China is not the only emerging financier for HPPs in developing countries. The Export-Import Bank of India has financed Rwanda’s Nyabarongo HPP; a consortium of Arab financiers, including the Arab Fund and the Islamic Development Bank, have financed Sudan’s Roseires II HPP; and the Brazilian construction firm Odebrecht has undertaken multiple HPPs in Africa, particularly in Lusophone countries.9 Nonetheless, China still leads the pack both in terms of financing and contracting.

The flurry of projects that were financed in the new millennium formed part of the broader China-Africa engagement that traces its roots to the Non-Aligned Movement during the Cold War and has been scaled up dramatically since 2000. Following independence from European colonialism, nonalignment was a time when liberated African countries learned to balance two superpowers while seeking to maximize their strategic benefits and bolster their sovereignty. China responded to these African priorities with its foreign policy framework based on mutual noninterference, a commitment that (at least formally) still guides how Beijing engages the continent.

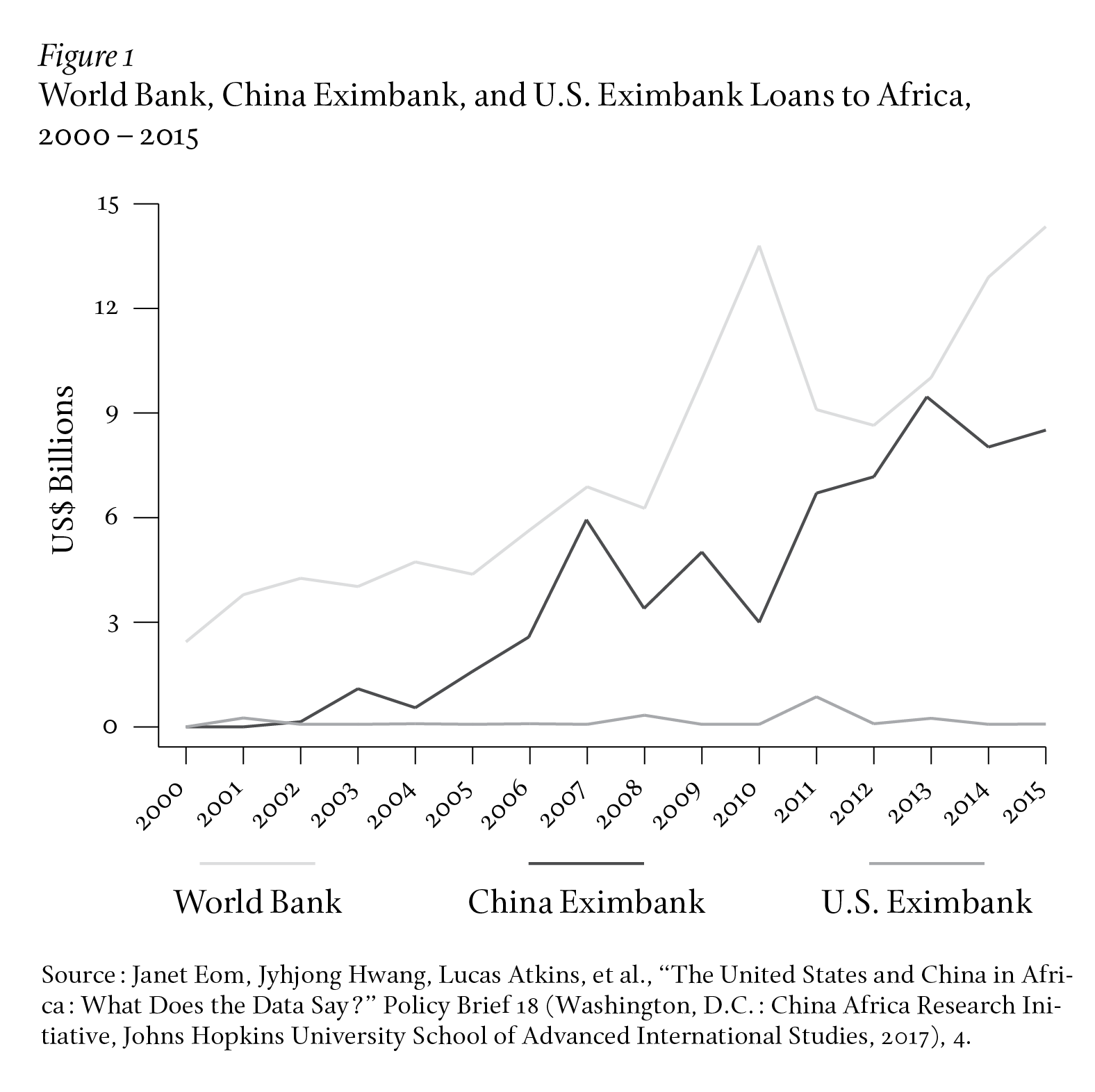

While there are no official figures of the influx of Chinese development finance into Africa, multiple sources have all pointed in the same direction. The World Bank’s Building Bridges report covering 2000–2007 put the cumulative figure at US$30 billion; the China Africa Research Initiative at Johns Hopkins University puts Chinese official loans for financing African projects in transportation, power, and communication alone at US$48 billion between 2000–2014; and China AidData at William & Mary University puts the amount at US$58 billion.10 The pattern is clear: Chinese financing in Africa, with infrastructure development as a leading sector, is now a significant and growing resource for developing countries (see Figure 1).

This influx of Chinese financing raised concerns, ranging from debt sustainability and governance to social and environmental regulations of the projects financed or contracted to Chinese actors. In March 2018, U.S. Secretary of State Rex Tillerson alleged that China’s approach in Africa

encourages dependency using opaque contracts, predatory loan practices, and corrupt deals that mire nations in debt and undercut their sovereignty, denying them their long-term, self-sustaining growth. Chinese investment does have the potential to address Africa’s infrastructure gap, but its approach has led to mounting debt and few, if any, jobs in most countries.11

While this statement reflects the Trump administration’s general hostility toward China, simplistic views from the media on Chinese financing in Africa receive considerable coverage, with headlines such as “While We [British] Indulge our Victorian Urge to Give Alms to Africa, Beijing Is Pumping Black Gold” and “How China’s Taking Over Africa, and Why the West Should Be VERY Worried.”12 In recent years, more nuanced studies have tackled the impact of Chinese development finance and contracting in Africa. The epithet of “rogue donor,” in which China flouts conditionality to finance dictators accused of abuses, along with the accusation of “debt trap diplomacy,” in which China supposedly offers unsustainably large loans to desperate borrowers to gain political leverage over them, have been challenged.13 Empirically rich field studies are emerging on the environmental and social impact (ESI) of Chinese-financed and Chinese-contracted projects in Africa, painting a complex and nuanced picture.

For instance, development scholars Keyi Tang and Yingjiao Shen have found that the Chinese-financed and Chinese-contracted Bui HPP in Ghana “has improved local urban households’ access to electricity and increased their ownership of electric appliances.”14 Public administration scholars Nancy Muthoni Githaiga and Wang Bing’s analysis of Kenya’s Mombasa-Nairobi Standard Gauge Railway, financed mostly with China Eximbank loans, indicated that the railway has had both positive and negative impacts: the project is associated with growth in the trade and construction sectors, but there are concerns about its sustainability and impact at the local level in terms of generating enough revenue to cover operation costs and loan repayment, its large external debt profile, and its opaque tendering process.15 Economist Bruno Martorano and colleagues have found that Chinese development assistance in social sector projects, such as piped water, can successfully improve households’ well-being, while assistance to other sectors, such as communication and transportation, does not exhibit significant results.16 Economist Axel Dreher and colleagues have pointed out that “Chinese development finance boosts short-term economic growth: an additional project increases growth by between 0.41 and 1.49 percentage points two years after commitment, on average.”17

More critically, Harry Verhoeven demonstrated that the choice of prioritizing quick project delivery to cement key partnerships in Africa is often a political one to keep governments in power, and in the case of the Merowe Dam and its dubious “associated projects” in Sudan, long-term economic sustainability and environmental and social impact all took a backseat.18 International Rivers, a nongovernment advocacy group, found that

China’s domestic policies have prioritized economic growth over the protection of the environment, with harrowing results. The Chinese government has set in place laws, regulations and institutions to protect the environment, but with limited success. China risks exporting its domestic environmental track record to other parts of the world through its foreign investment strategy. Its domestic environmental policies may even encourage China’s worst polluters to relocate their production to places like Africa.19

A key emerging observation is that much of the impact of Chinese finance and contracting is dependent on the host country’s agency and capabilities. China-Africa scholar Deborah Brautigam and Hwang found that China Eximbank

requires an environmental impact assessment (EIA) to be conducted, based on the host country’s environmental policies and standards. However, if the host country’s policies are not “complete” then the assessment should be based on China’s own standards or international practice. . . . If borrowers do not mitigate serious environmental and social problems caused by the project, China Eximbank reserves the right to stop loan disbursements and require early repayment. It is not known how strict China Eximbank has been in applying these guidelines.20

International relations scholar May Tan-Mullins and colleagues observed that

Chinese dam builders usually attempt to adhere to the social and environmental policies and guidelines of the host country, in so far as they exist. In the absence of such policies and guidelines, Chinese dam builders will usually attempt to follow China’s domestic policies and guidelines. The national host context therefore determines the quality of the impact mitigation of large dams. However, according to our interviewees, many of these guidelines are not enforced, are very general and need to be more sector specific.21

And development scholar Oliver Hensengerth’s study of Sinohydro in Ghana’s Bui HPP shows

that the contractual setting in which Chinese companies operate and the governance setting of the host country are the key factors in determining whether or not strict environmental protection measures are implemented in projects with Chinese involvement and whether Chinese firms apply international norms, the norms of the host country, or Chinese norms.22

In a comparative study of two HPPs in Cameroon, one financed by the World Bank and one by China Eximbank, development scholars Yunnan Chen and David Landry also found that Eximbank is more inclined to leave the ESI enforcement to the host country, and does not pressure the host to alter enforcement practices as the World Bank does.23 The 2015 Brookings report Financing African Infrastructure points out that even though the World Bank has “played a critical, though sometimes controversial, role in setting standards for investment design, evaluation, and implementation. . . . Ultimately, however, it is the African nations that must agree on the standards and principles that they will apply.”24

This essay will demonstrate through the case study of the Mount Coffee HPP in Liberia that host countries strategically allocate financing from different sources to different projects, based on domestic development needs, administrative capacity, flexibility of financiers, and institutional memory between the host and the financiers. More broadly, this case study provides empirical observations of host countries’ agency and strategic calculus in the financier-host relation, as well as the limits of China’s role in Africa’s hydropower sector.

In 2012, Liberian President Ellen Johnson Sirleaf signed the first of a series of financing agreements, predominantly grants, followed by contracts, with financiers from Organisation for Economic Co-operation and Development (OECD) countries for the reconstruction of the Mount Coffee HPP. These signings occurred despite explicit interest from Chinese officials and Chinese companies to both finance and contract the project. The desire to fund and carry out the rehabilitation of the Mount Coffee HPP was supposed to demonstrate China’s commitment to the newly reestablished Sino-Liberian diplomatic ties in 2003. The unexpected setback for Beijing makes the Mount Coffee project a “hard case” for Chinese dominance in the sector: if Chinese financing and contractors are indeed dominating the African hydropower sector, how is it that China is not able to make headway into the Mount Coffee project despite explicit interest in it? OECD financiers and contractors were not the only partners available to Liberia, so the outcome of staying with OECD partners is not one of necessity, but one of choice. Mount Coffee is a rare case that demonstrates host country agency vis-à-vis financiers, but also shows the limit of financiers’ influence in development project financing.

In 1964, U.S.-based Stanley Engineering Company was contracted to carry out the design, specification, and supervision of a 34-megawatt hydropower station on the St. Paul River, 27 kilometers north of the Liberian capital, Monrovia. The project was funded by a mix of Western financiers: four different World Bank loans between 1970 and 1978 totaling US$24 million, and two loans totaling US$4 million from the German government. The project contained four vertical Francis turbines, three dam sections, ten flood control gates, and a 69 kilovolt substation and transmission line. Upon completion in 1967, the Mount Coffee HPP was Liberia’s largest source of electricity, supplying 35 percent of the country’s capacity.

The first Liberian Civil War broke out in 1989. In 1990, rebel forces led by Charles Taylor took control of the power station and ceased its power generation. Operators were prevented from entering the facility to open the spillway gates, causing the dam to overtop during the rainy season. Throughout the next fifteen years of civil war, the power station’s electrical, mechanical, and transmission equipment were looted.25 When the democratically elected government of Ellen Johnson Sirleaf took office in 2006, they faced the challenge of rebuilding a country whose infrastructure had been destroyed by conflict. Electricity access was particularly dismal. Even before the decimation of the Mount Coffee project, only 13 percent of the population had access to electricity. By the time surveyors returned, only part of the dam and the steel pressure pipes remained.

The Mount Coffee project is a run-of-the-river hydropower project. This type of HPP takes advantage of a bend in the river that also straddles an elevation change. The geography allows the construction of a “shortcut” across the bend, through which water upstream of the bend travels down at a higher speed to propel the turbines installed at the bottom of the shortcut. Water exiting the turbines is fed back into the river downstream. Such a design alone does not require the flooding of large reservoirs and is therefore often considered as having a less nefarious ESI than projects that require damming and flooding. However, the output of run-of-the-river projects is generally more variable due to rainfall.26

In November 2006, the U.S. Trade and Development Agency (USTDA), an independent agency designed to support “U.S. goods and services for priority development projects in emerging economies,” opened two grant lines for a “Technical and Financial Feasibility Study for the Reconstruction and Expansion of the Mount Coffee Hydropower Facility in Liberia.” In May 2007, the Liberian government issued a tendering for feasibility studies for the rehabilitation and expansion of the project, with the support of a US$400,000 grant from the USTDA. The tendering was then postponed and later reopened in September 2007 with a modified budget. The grant amount was also increased to US$531,500. Only U.S. firms could bid for the project, per the agreement of grant projects funded by the USTDA. However, the contractor may utilize Liberian subcontractors for up to 20 percent of the grant amount.

U.S. interest in the project was neither coincidental, nor did it manifest itself in isolation. The United States had a long history of intervening in Liberia’s politics, dating back to the end of the U.S. Civil War in 1865.27 Relations with the United States soured during Charles Taylor’s administration, who was perceived as an illegitimate warlord by Washington despite considerable domestic support, but improved when Ellen Johnson Sirleaf was sworn into office as the first elected female head of state in Africa.28 Born of Indigenous parents but raised in an Americo-Liberian household, she later completed her master’s degree in public administration at Harvard University. She continues to maintain a largely positive image in the West, eventually receiving the Nobel Peace Prize in 2011.29

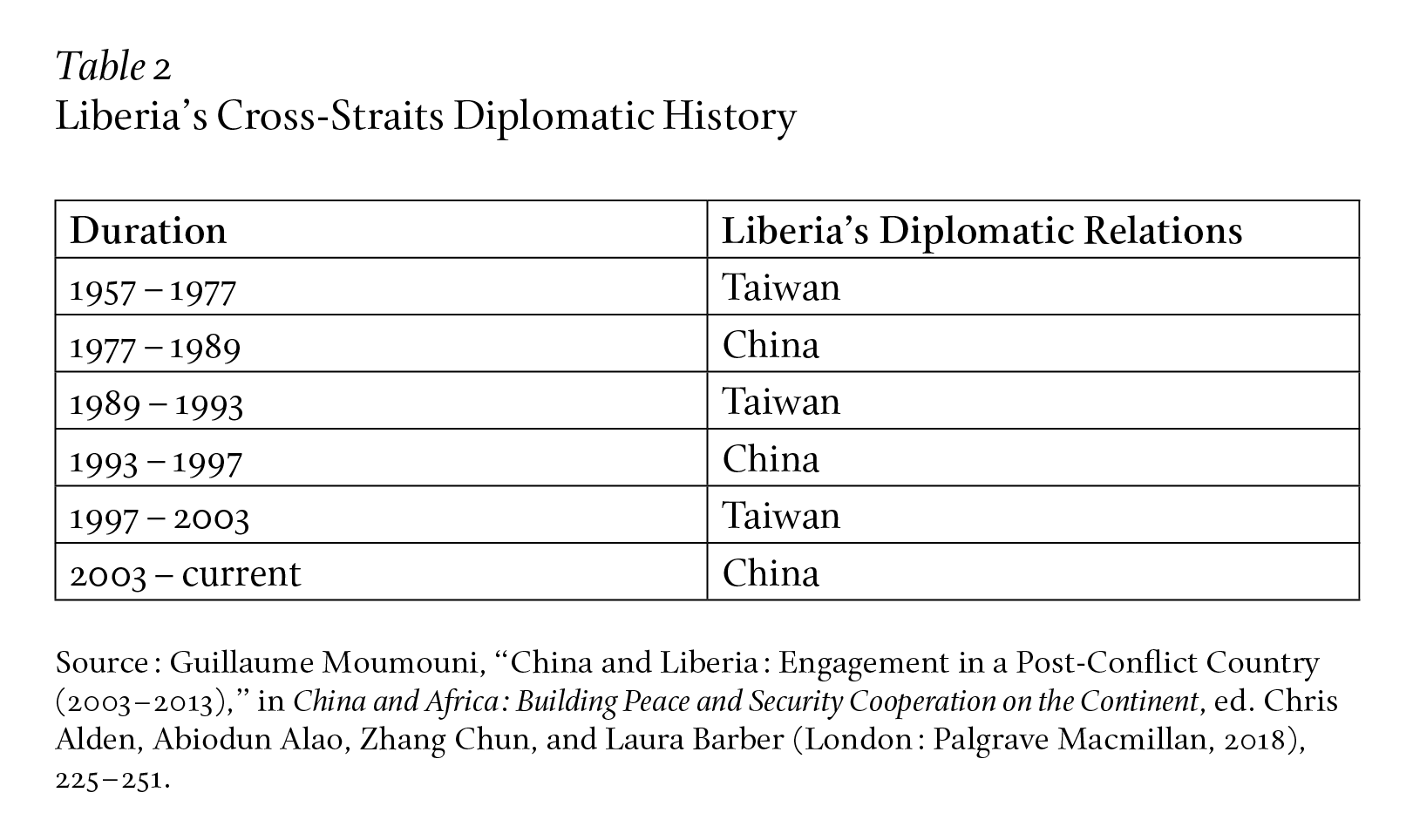

While the tendering for the rehabilitation of the Mount Coffee project was underway, in July 2007, the Economic and Commercial Office (ECC) of the Chinese embassy in Liberia translated a Liberian news article, which quoted the CEO of Liberia Electricity Corporation (LEC) in stating that the upgrade and repair of the Mount Coffee HPP and the accompanying Via Storage Reservoir upstream would cost about US$500 million. A team of specialists (that is, Stanley Consultants) were already on the ground to explore the possibility of expanding the project to up to 100 megawatts. The ECCs are typically physically located within Chinese embassies but are under the jurisdiction of China’s Ministry of Commerce. Part of the ECC’s role is to facilitate Chinese businesses operating in foreign countries. Most of the press releases from Liberia’s ECC cover signing of local contracts with Chinese companies, groundbreaking ceremonies of Chinese-contracted projects, or official visits by local and Chinese officials to Chinese-contracted projects. The articles that the ECC chooses to translate and publish are not a random selection; they only include events that they believe to be useful for Chinese contractors. Their interest in the Mount Coffee HPP was clearly commercial but should not (like that of the United States) be separated from broader bilateral considerations. Liberia has repeatedly changed its diplomatic recognition between China and Taiwan (see Table 2). The post-2003 reestablishment of relations was a great diplomatic success for Beijing, which was eager to maintain this relation with Sirleaf’s government. At the time, only Senegal, Chad, Malawi, Gambia, São Tomé and Príncipe, Burkina Faso, and Eswatini still maintained relations with Taipei, and Beijing wanted to demonstrate the benefits of switching sides.

It is unclear who and how many bids were submitted for the feasibility study, but by the end of 2007, the LEC awarded the contract to the U.S.-based Stanley Consultants. This outcome was not surprising. Stanley Consultants was the original design engineer of the Mount Coffee HPP when it was first constructed in the 1960s. Stanley Consultants’ recommendations included repairs for the dam, strengthening the turbine’s anchors, and repairing the foundations of the powerhouse’s building structure. Moreover, the Mount Coffee project’s dependence on rainfall as a run-of-the-river project was problematic since it was meant to serve as Liberia’s largest generating facility for years to come. Thus, Stanley Consultants developed the project to be compatible with a potential upstream storage facility, the Via Reservoir, to improve reliability and output in the future.

In September 2008, development officials from Japan, the Netherlands, Norway, Sweden, the United States, the United Nations, and the International Monetary Fund, as well as representatives from other international financial and donor institutions arrived in Liberia to attend the Liberia Reconstruction and Development Committee (LRDC) forum. The LRDC, a government-donor group, was created in 2006 after Sirleaf took office.30 In the September meeting, Sirleaf expressed “dissatisfaction with the timeline between the process of commitments and implementation of the commitments.” However, she welcomed discussions on the need for budgetary support to Liberia and acknowledged that the enduring challenge of corruption made it harder for Western donors to engage. Her dissatisfaction with the slow progress was reiterated multiple times during the conference: “If you say, put it through our bidding process, I will say no. I’ll give it to who will build it; we are going to give it to somebody. If it’s got to be a private sector thing, we’ve got to get it done.” While she reiterated her support for the public bidding process, a condition required by all the financiers of the project, it was clear that priorities between the host and the financiers are often at odds.

Sirleaf’s frustration with the slow pace of the project’s construction, including the bidding process, did not go unnoticed. Missing from the LRDC meetings was China, which was just starting to ramp up investment activities in Liberia. In 2006, China signed a US$5 million grant with Sirleaf, much of which went to the renovation of the Samuel Kanyon Doe (SKD) Sports Complex that was contracted to Hunan Construction Engineering Group.31 As the OECD delegation left Libera, Sirleaf, accompanied by Chinese Ambassador Zhou Yuxiao and ECC counselor Liu Yun, met with representatives from Sinohydro, one of the most active contractors building HPPs in Africa. Sinohydro introduced their own studies of the Mount Coffee hydropower rehabilitation project. Sirleaf emphasized that the expansion of the mining and forestry industry created a large potential customer base for the Mount Coffee project and that the Liberian government would expedite the project.

At the time, Sinohydro had already won contracts for Ethiopia’s Tekeze HPP, jointly with another Chinese hydropower giant Gezhouba, as well as several other contracts, building its global reputation as the dominant player in the dam industry (see Table 3). Some of these projects, like Kariba North, were financed by China Eximbank, which, like the USTDA grant, required a Chinese contractor. But Sinohydro was capable of winning contracts for projects with non-Chinese financiers as well.

For China Eximbank financing, the host country is expected to “apply for the export credit before the EPC contract is signed, though they sign the loan agreement only after the EPC contract.” In other words, Chinese contractors must first compete for the contract before jointly applying for loan financing from Eximbank with their African hosts.32 The potential financing that a Chinese contractor can leverage is often a game-changer. Up until 2008, China Eximbank has provided concessional loans covering anywhere from 75 to 100 percent of project costs.33

However, China was not the only financier in the game. In European Investment Bank’s 2009 annual report, Secretary General Amadou Diallo of the West African Power Pool (WAPP), of which Liberia is a member, stated that “the WAPP is highly interested in securing the support of the Trust Fund in developing future potential projects such as the rehabilitation/reconstruction of the 64 MW Mount Coffee hydropower Facility in Liberia and further interconnection and reinforcement projects as well as capacity building.”

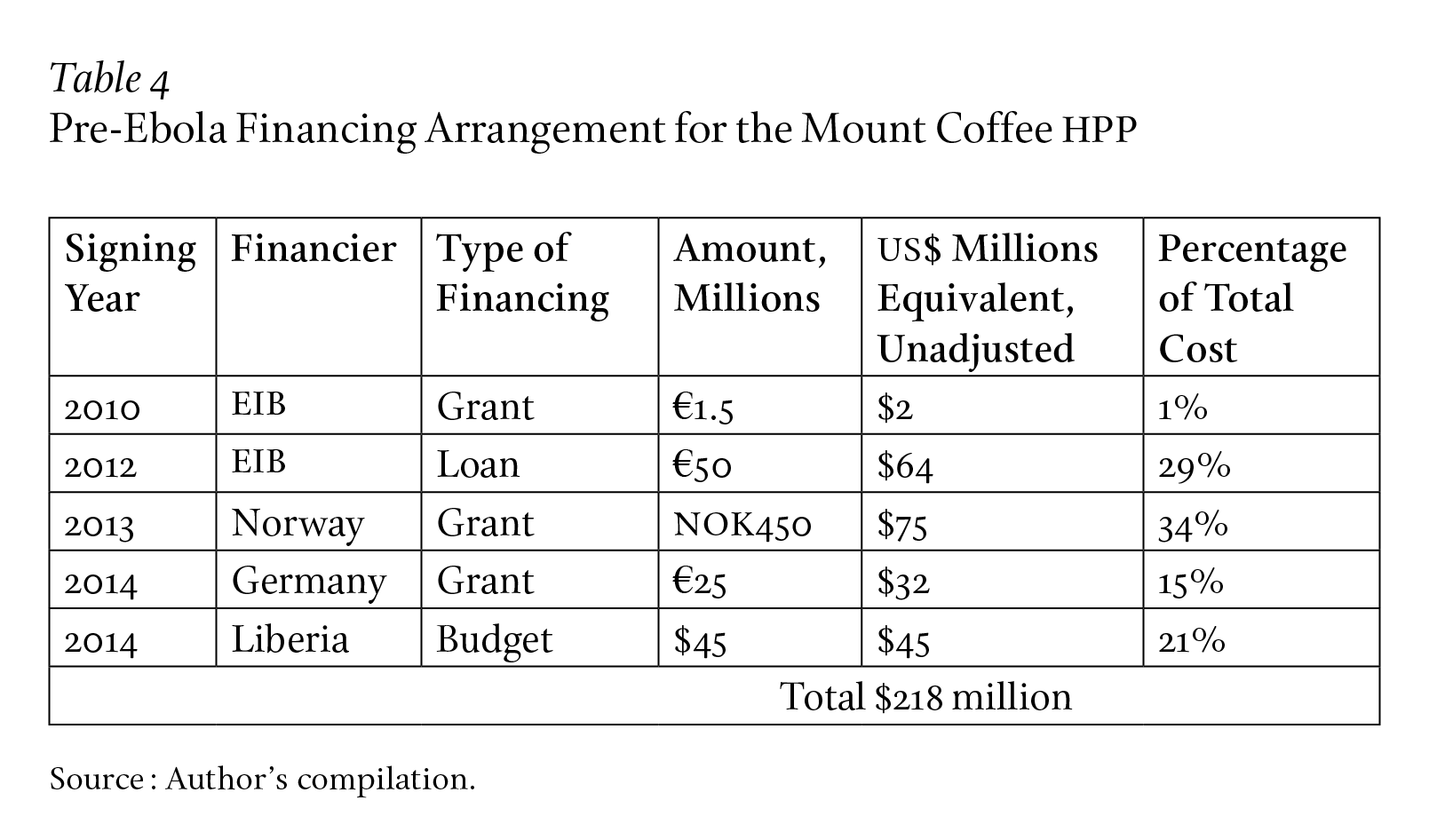

Even though a single Eximbank loan could have covered the entire project, the government of Liberia pushed for a different financing model. Against the odds, it was able to overcome significant aid fragmentation, negotiating with multiple OECD financiers to patch together grants that greatly reduced the country’s debt burden, and even renegotiated for supplementary grants. By December 2012, Liberia had secured a US$64 million concessional loan from the European Investment Bank (EIB) (see Table 4).

Even as negotiations for a concessional loan with the EIB were underway, Liberia explored possible Chinese financing, and the Chinese did not give up the possibility of winning a large contract for their companies. During a meeting with Ambassador Zhao Jinhua in April 2012, Internal Affairs Minister Blamoh Nelson “named the rehabilitation and expansion of the Mount Coffee Hydro plant . . . which China could assist.”

In July 2012, a ten-member delegation from China arrived, headed by Zhang Xiaoqiang, vice chairman of the National Development and Reform Commission, which is managed by the State Council of China. In her opening remarks, Sirleaf emphasized that it was time to “fast-track on the priority areas of job creation and infrastructure–of roads, power and ports.” Zhang replied by highlighting the capacity of Chinese contractors to tackle the Mount Coffee project, proposing “that the Liberian Government and China should sign the relevant documents for Mount Coffee as soon as possible and discuss financial plans for cooperation.” Instead, Sirleaf wanted the rice production project and the existing iron-mining project by China to move ahead. She said that there was already a partnership working to restore Mount Coffee, but she “encouraged the Chinese to engage in the bidding process for the manufacture of the turbines that would be needed, and also to consider a partnership for phase 2 of the hydroproject for upstream storage capacity,” referring to a public bid on turbines and other equipment for Mount Coffee that opened in April and the Via Reservoir project upstream to Mount Coffee, recommended by Stanley Consultants to increase the project’s capacity. However, Zhang emphasized that

because of the many demands, there was no time for negotiations that could take up to a year. He called for agreement on a priority project, like Mount Coffee, and to move quickly. If the two governments and relevant institutions could reach agreement, China could provide financial support, as well as the experts, and after two years Liberia would have power.

Nonetheless, Sirleaf maintained that “the first phase already had four important partners, namely, the World Bank, the United States, Germany and Norway. She pointed out that any company could bid on the phase 1 turbines, and with Chinese companies already on the ground, they would be in a good position.”34 Yet the bidding process for those turbines did not go China’s way: it was ultimately Voith Hydro, a multinational engineering contractor based in Germany, that was awarded the contract in October 2013.35 While there are many possible factors behind this choice, one that stands out in particular was that Mount Coffee’s original Francis turbines were supplied by the U.S. manufacturer Allis Chalmers in 1966 and 1971, and Voith Hydro subsequently bought out Allis Chalmers in 1986.

A major difference between Mount Coffee’s contracting process and what Sinohydro is familiar with was that different components of the project were independently contracted. A second invitation to bid was issued in November 2013 for the rest of the project. There were clear signals from the Chinese EEC in Liberia encouraging Chinese companies to compete for this project: it was the only project whose bidding profile was translated on EEC’s website. It is unclear if any Chinese companies participated in the bid, but ultimately no Chinese companies participated in the project. UK-based Dawnus Construction was awarded the contract for civil works; Austrian-based Andritz won the contract for the hydraulic steelwork and auxiliary systems; Swedish ELTEL was tasked with the transmission lines to Monrovia; the construction work camp contract went to a joint venture consisting of three Liberian companies; the Norwegian Norplan AS and the German Fichtner GmbH won the contract to serve as the owner’s engineer in representing Liberia; the NCC, a subsidiary of the Saudi company Rezayat, was awarded the contract for substations; and the operations training and maintenance contract went to the Swiss company Hydro Operation International.36 This group of international contractors formed the Project Implementation Unit of the Mount Coffee project. While Chinese companies could potentially compete for the Via Reservoir project, plans for that project have yet to be announced by Liberia.

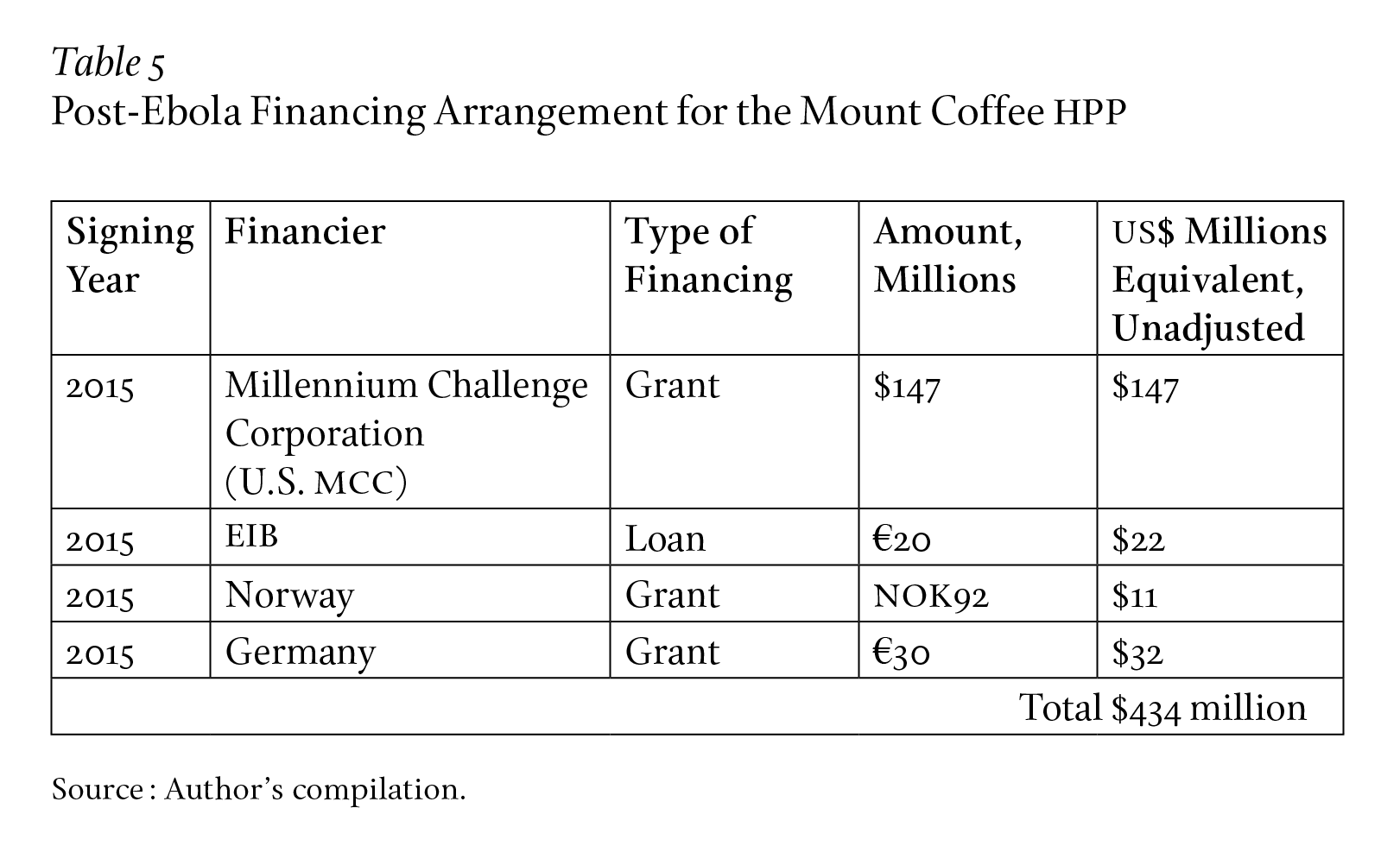

In December 2013, the Mount Coffee rehabilitation project officially broke ground with great fanfare. However, by August 2014, the World Health Organization declared the Ebola outbreak in West Africa a public health emergency of international concern. Liberia was at the epicenter of the epidemic and would ultimately sustain over 4,800 deaths. With public health measures in place and travel restricted, the project faced growing costs. As budgets tightened throughout 2014 and 2015, along with underbudgeting and exchange rate fluctuations, Liberia faced difficulties in coming up with the necessary funds as the epidemic slowed construction and further increased cost. Liberia approached the OECD financiers for an increase in support, while adding the U.S. government to the list of financiers. Once again, despite the need to negotiate with multiple financiers to patch together a budget mostly made of grants, there was no indication that Liberia ever approached China for loan financing (see Table 5).

In the end, the project was completed without the involvement of Chinese contractors or financing. The first turbine went online in December 2016, and by 2018, all four turbines of Mount Coffee went online.

What explains Liberia’s behavior that seems to sit so starkly at odds with popular discourses that paint China as a nigh-unbeatable competitor when it comes to infrastructure bids? Much of it is strategic allocation by Liberia: the unexpected willingness and capacity of the government of a low-income African country to defend its interests. “Strategic” here implies more than economic rationality; it refers to the weighing of political, social, and financial pros and cons over long time horizons.

The U.S. Millennium Challenge Corporation (MCC), which contributed the bulk of the financing for Mount Coffee, has explicit requirements for the economic, social, and environmental conditions for the project, as do EIB financing. In other words, while OECD financing tends to be grant-based or very concessional, there are only certain projects that Western financiers will fund. Construction of government buildings or stadiums generally cannot be financed through OECD mechanisms. In contrast, Chinese grants can support those types of projects; there is no formal process to apply for Chinese grants like there are for the U.S. MCC or EIB loans. The flood of Chinese grants after reestablishing diplomatic ties with Beijing makes it very clear that these are diplomatic tools. Whatever development impact these Chinese grants may generate is up to the recipient country to decide, with a preference to use Chinese contractors if possible. When China gave a US$36 million grant in 2013, Ambassador Zhao Jianhua stated that “it’s money for the projects that have been agreed upon which are being simultaneously worked on at the moment.” Projects “agreed upon” by China and by the grant recipient country is a common description of how Chinese grants are used: “grant shall be utilized to implement projects agreed upon through consultation between the two governments” described a grant to Botswana in 2009, and an agricultural center in Nigeria was “agreed upon by the two sides during President Buhari’s state visit to China last April [and] is going to be fully funded as a grant project in this category.”37 To a certain extent, the way Chinese grants are used by both China and the grant recipients is more like an allowance, with the only semi-rigid condition being that Chinese contractors are prioritized when possible.

Nothing stopped the Monrovia government from using Chinese grants to shore up financing for Mount Coffee in 2015, particularly when Liberia’s own contributions fell short. However, that might not have been the best approach since OECD financiers are more than willing to fill budget shortfalls for projects that qualify, while Chinese grants can be used to plug other budget shortfalls, especially for projects that are not financeable by the OECD. In other words, Chinese grants were more useful as a “slush fund” for Liberia. Even if China routinely practices “stadium diplomacy” to maximize its project visibility or to benefit Chinese contractors, it would be difficult to argue that the SKD renovation, repeatedly financed with Chinese grants, was forced upon Liberia.38 In the decade immediately following the reestablishment of diplomatic relations, China’s priority was to demonstrate, to the few countries left who still had diplomatic relations with Taiwan, the benefits of establishing relations with Beijing; strong-arming Liberia into accepting a stadium renovation project would be counterproductive. A more likely explanation is that the demand from Liberia for the stadium was met by Chinese supply, which was simply not available from OECD financiers.39

Since OECD financing has a comparatively higher grant element but is more restrictive in terms of environmental and social assessment (ESA) (and Chinese financing has a comparatively lower grant element but is more permissive in terms of ESA), the goal of the Sirleaf government was to maximize the grant element across projects with a range of ESA performances. In this strategic approach to financing, OECD financiers covered the high-ESA projects, while Monrovia uses Chinese financing to cover whatever OECD financiers were not willing to fund.

In doing so, Liberia has demonstrated that it is (almost) uniquely capable of negotiating aid fragmentation, patching together a variety of grants from multiple sources and holding multiple public biddings for each stage of the project. While time-consuming and politically not without risks, this approach can maximize grants and reduce the reliance on loans. Sirleaf has taken pride in Liberia as “a prime example of an African nation standing up to Chinese policies.” She further stated that “In Liberia, we’re trying to settle our huge debt problem. China wanted to provide some resources on the basis of sovereign guarantees. We said no, we can’t take your money on that basis.”

What makes this all the more remarkable is that there are very few if any financiers like China Eximbank and China Development Bank that can single-handedly offer financing in the millions if not billions of dollars. The single largest World Bank loan was awarded to France’s Monnet Plan in 1947 for US$500 million (valued at US$6.1 billion in 2021 terms). The China Eximbank financed the Standard Gauge Railway in 2013 with the Kenyan government for US$3.6 billion. China’s willingness to tolerate considerable risks and go big means that what formerly would have required three or four financing agreements with multiple OECD financiers can now be financed by a single financier.

The streamlined service and financing provided by Chinese companies are attractive to host countries that have less capacity or willingness to actively manage donors and creditors. Chinese companies and official agencies often tout their vertically integrated service as a competitive edge abroad, not just to potential customers, but to their own domestic audience. The China Energy Engineering Corporation (CEEC) proclaimed in a press release in Chinese that “as the largest power utility company that supplies comprehensive services in China and in the world, CEEC’s whole supply chain and whole life cycle services are unique strengths when undertaking mutual cooperation in infrastructure development in Africa.” The Economic Daily, a China Communist Party publication, highlights (in Chinese) how the state-owned China Guodian Corporation’s De Aar Wind Farm project in South Africa offered comprehensive services, from the preliminary work of wind measurements, environmental assessment, and land leases, to bidding, financing, construction, installation, and final project inspection and acceptance.40 Liberia, however, chose a resolutely different path, seeing merits in aid fragmentation (despite increasing direct and indirect transaction costs), if strategically managed.41

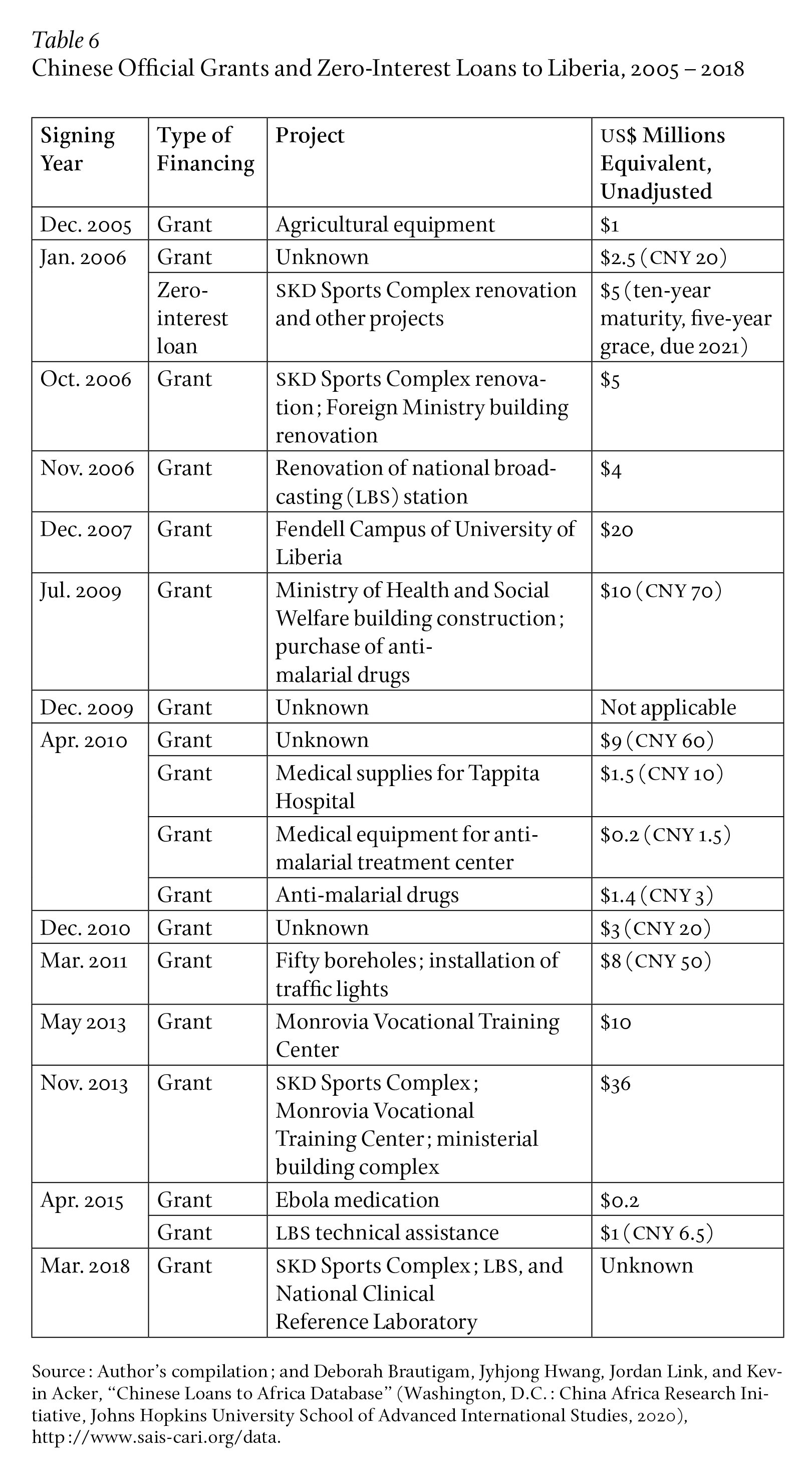

It is important to point out that Liberia’s decision not to work with China on the Mount Coffee rehabilitation project did not imply a general snubbing of China, or its exclusion from many other important infrastructure projects. Since reestablishing diplomatic relations in 2003, a slew of grants were signed for a range of initiatives (see Table 6). The amount of the grants offered by China to Liberia is unusual considering what other African countries have received.42 Cumulative grant amounts from 2003 to 2015 exceeded US$110 million. However, even when budgets were tightened in 2015 due to the Ebola epidemic, Liberia opted to request additional funding from existing financiers for the Mount Coffee HPP.

Are Chinese companies intrinsically incapable or unwilling to build high-ESA-performing HPPs, or do Chinese financiers have a penchant for low-ESA-performing projects? Past records show this is clearly not the case: Bankasoka and Gouina are run-of-the-river HPPs in Sierra Leone and Mali, respectively. Bankasoka was financed jointly by the UN Industrial Development Organization and the Chinese government and contracted to Hunan Construction Engineering Group Cooperation; Gouina was financed solely by China Eximbank and constructed by Sinohydro. Sondu-Miriu in Kenya is another run-of-the-river HPP financed by Japan and contracted to Sinohydro. However, as the Mount Coffee case demonstrates, ceteris paribus, the host country chooses the better financing offers available, and that often means OECD financiers.

As Chinese financiers and contractors gain market share in HPPs in developing countries, concerns regarding funding practices and a disregard for the environmental and social impact of the projects will continue to be of relevance, independent even of the geopolitical developments that might also play into critiques of Beijing. But as this essay has shown, the question of who gets which contracts is more than a competition between cheap and easy Chinese financing and expertise versus more expensive but more socially and environmentally responsible Western assistance. The analysis presented draws attention to the agency of African states and their own strategic considerations as they play various development partners against each other. Indeed, competition in development financing allows us to observe formerly latent agentic behavior from the host country, independent of the preferences of the financiers (whether Western or Chinese). Prior to the 2000s, there were no meaningful alternatives to OECD creditors/donors, and discussions about host country agency vis-à-vis financiers were mostly a hypothesis without empirical data. The entry of China into the world of development finance allows us to observe host country agency in action, not unlike during the Cold War. The Mount Coffee story underlines that host government administrative capacity is crucial for strategic allocation of financing and, therefore, how seriously the concern over growing water scarcity in the age of climate change will be taken. The ability to navigate the comparatively more fragmented financing from OECD sources decreases the desirability of Chinese loan financing as a singular source for dam and irrigation projects. The empirical outcome that seems to associate Chinese financed and contracted projects with higher ESI is a case of self-selection; OECD financiers compete harder for a smaller range of high-ESI projects than Chinese financiers. Chinese contractors are interested in all contracts, both low- and high-ESI ones, and will accord similar efforts to winning both types of contracts. In contrast, OECD financiers have fewer projects that they can finance due to ESI concerns, and thus focus comparatively more of their capacity to accessing projects that are low impact only, including offering better grant-element financing. One implication from this observation is that asking China to finance more low-impact projects may only increase competition for projects that are already heavily competed after, with unclear benefits to the host country.

As far as Chinese contractors are concerned, their priority is to acquire contracts. The competition can sometimes turn ugly even between Chinese contractors.43 If they can win high-ESA-performing contracts, fine; if not, they will take other contracts. While they are capable of taking high-ESA-performing projects, that is in fact not what the companies themselves consider to be their areas of comparative advantage.44 In an article by researcher Lizhi Zhou at the State Grid Corporation of China’s South Africa office, it is argued that Chinese companies have clear advantages in development HPPs in Africa in two particular areas: 1) prodigious experience in planning, construction, and technical expertise, as well as management across these areas; and 2) construction costs are generally lower compared to that of contractors from other countries, “sometimes 20%–30% lower than those from Western countries.”45 This article was published in Chinese, by the largest state-owned electric utility company in China, with Chinese companies as the intended audience.

This self-image of having high technical ability accompanied by low cost is shared by Chinese hydropower construction companies. State-owned Assets Supervision and Administration Commission issued a press release in 2006 highlighting Sinohydro’s progress in African hydropower, particularly in the company’s ability to streamline bidding, financing, and construction. The article further states that Sinohydro targets “large projects, large markets,” particularly projects with a higher impact on the country or the region.46 By the 2010s, interest in smaller HPPs among Chinese companies was also increasing. In an interview with experts at the International Center on Small Hydropower, a research group jointly managed by China’s Ministry of Commerce and Ministry of Water Resources, they emphasized that small hydroprojects are uniquely suitable for Africa due to their low entry cost, and Chinese companies have technical and cost advantages in developing small African hydroprojects. In other words, the shift toward smaller projects is less a reaction to ESI concerns, and more a cost-reducing solution.47 While the Chinese government is increasingly aware of the environmental impacts of their projects, the rhetoric remains that hydropower is a relatively cheap and clean energy source.48

The case of the Mount Coffee HPP demonstrates that, despite the apparent power asymmetry between financiers and the host country, given sufficient competition in both financing sources and host country capacity, a host country can exercise agency to maximize their domestic and international interests. Not all offers need to be accepted. This is a different story than the one popularized in the Western media, where African states are either gullible or desperate enough to take any Chinese financing or investment coming their way, while comparatively cash-strapped OECD financiers wring their hands. This story ended with the host country allocating available financing the way they preferred, and in a way that is not preferred by either the OECD or Chinese partners. If Chinese partners had any say, they would get the contract if not also the financing opportunity for the Mount Coffee HPP; if OECD actors had any say, they would prefer that Liberia use the flexible Chinese grants on something other than stadiums. Yet competition in development financing and the Liberian government’s own negotiating capacity meant that Liberia had the final say, and both the HPP and the stadium were financed.

Water security is a multisectoral challenge for developing countries, encompassing agriculture, health, and energy. However, understanding the future of water security is not just about highlighting why water security is important, or even which policies will best achieve that. It is also about understanding the domestic and international factors that permit or constraint the host countries’ abilities to respond and prioritize resources. These factors, being intimately tied to preferences and perceptions, are often only best known by the host countries themselves.

Given the importance of competition for host country agency, the gradual reentry of the World Bank into HPPs since the WDC may prove beneficial in the long run. The World Bank’s Dams and Development Project (DDP), particularly the fourth DDP forum in 2005, stressed the importance of moving on from “polarized discussion on whether to build dams or not to a more constructive discussion about how to build ‘good’ dams if they emerge as the best option.” Competition cannot be achieved by replacing one monopoly with another, and having a competitive alternative to Chinese financiers and contractors will offer more choices for host countries to exercise their agency. The growing demand for small HPPs from host countries may be a chance for both OECD and Chinese actors to cooperate, combining stringent ESA and better financing terms with low cost and quick delivery.

© 2021 by the American Academy of Arts & Sciences. Published under a CC BY-NC 4.0 license.