Failure to Respond to Rising Income Inequality: Processes That Legitimize Growing Disparities

Why is there not more public outcry in the face of rising income inequality? Although public choice models predict that rising inequality will spur public demand for redistribution, evidence often fails to support this view. We explain this lack of outcry by considering social-psychological processes contextualized within the spatial, institutional, and political context that combine to dampen dissent. We contend that rising inequality can activate the very psychological processes that stifle outcry, causing people to be blind to the true extent of inequality, to legitimize rising disparities, and to reject redistribution as an effective solution. As a result, these psychological processes reproduce and exacerbate inequality and legitimize the institutions that produce it. Finally, we explore ways to disrupt the processes perpetuating this cycle.

The last few decades have seen a marked trend toward rising income inequality in many nations, rooted in an increasingly large share of wealth controlled by the rich.1 Heightened income inequality within a society has been linked to adverse outcomes, including reduced social capital, trust, and community support; higher rates of mortality; and increased violent crime.2 Under such conditions, people – particularly those disadvantaged by inequality – might be expected to protest income inequality and vote for politicians who promise to reduce it. Such an assumption is contained in classic public choice models of self-interested, rational voters, such as the Meltzer-Richard Model (MRM).3 This model contends that, as income inequality increases – and the median income drops in relation to the mean income – the median voter will prefer greater redistribution, vote accordingly, and thereby influence tax and public goods policies that counter excessive income disparities. Yet in many nations, this is not the case. Instead, public opposition to escalating income inequality and support for redistribution are often surprisingly underwhelming.

In this essay, we consider the social-psychological processes that contribute to the maintenance and acceleration of inequality, particularly in a highly unequal environment. We propose that, as income inequality grows over time, some people may indeed recognize and revile it. However, the very context of rising inequality may trigger processes that dampen opposition to inequality. As inequality rises, people may become increasingly blind to its true magnitude. Heightened inequality may lead people to rationalize and legitimize greater disparities, and to find redistribution inappropriate. We articulate how each of these psychological processes are situated within and causally connected to broader, multilevel systems (such as media and political processes) that trigger them.

To analyze these processes systematically, we use the influential MRM as a foil. Although many theorists challenge the assumption that rational voters make informed choices, the model has nonetheless motivated an enormous amount of research in fields such as political science, political economics, and sociology.4 Many of these studies have failed to find support for the MRM. Most of these studies, however, have not considered the failure of this intuitively appealing model through a social-psychological lens. Thus, we provide a novel contribution to a variety of disciplines by analyzing the social-psychological processes that can disrupt each step in the MRM.

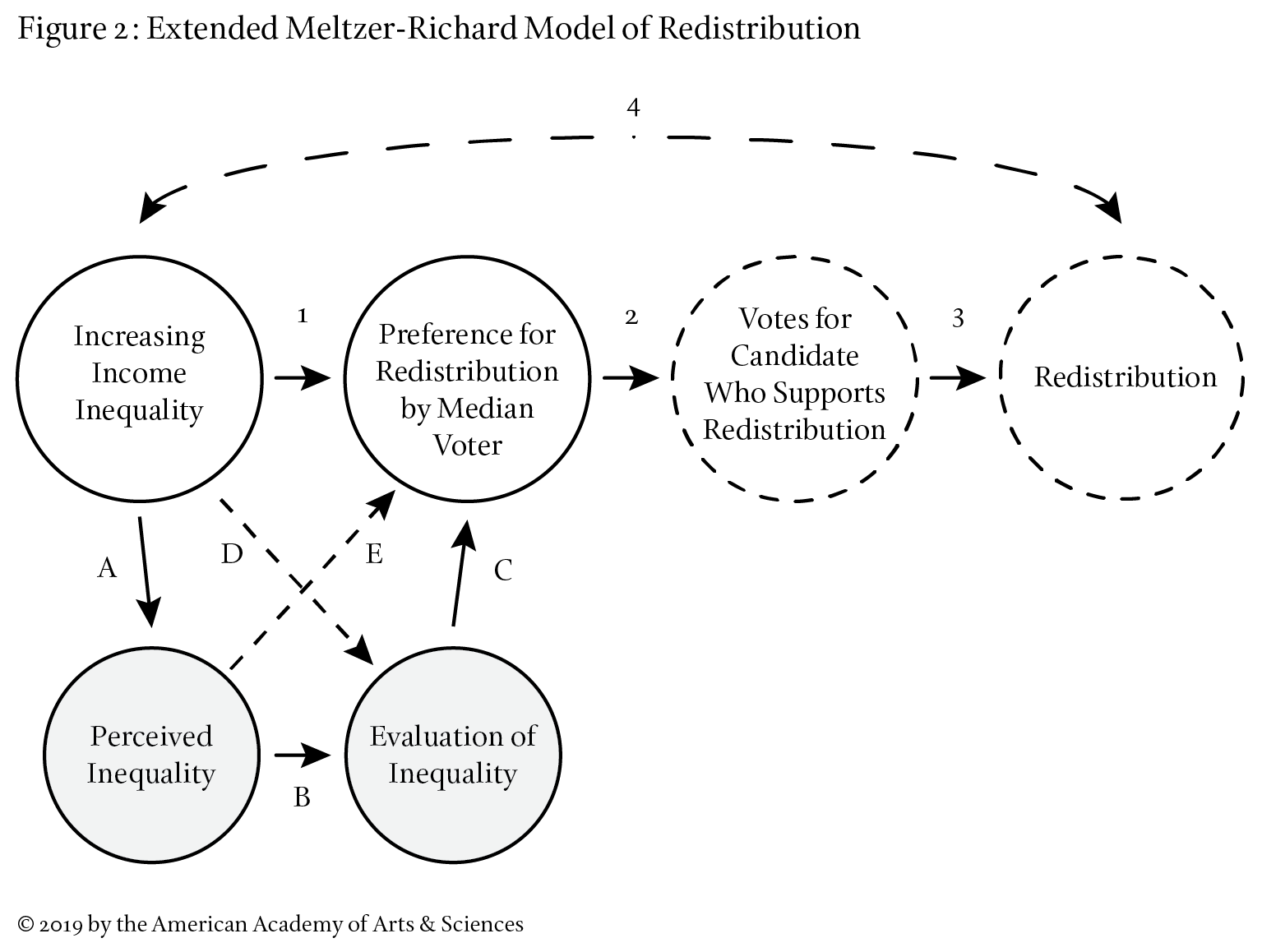

We structure this essay by breaking down the MRM into its principal assumptions, key constructs, and evident paths, noting also the constructs and paths that we believe are missing, or are only implicit, in this model. We consider and provide examples of how people’s experiences and responses to income inequality are affected by, and in turn can reciprocally influence, macrolevel factors (such as cultural narratives and economic conditions), mesolevel factors (such as spatial segregation based on socioeconomic status), and microlevel factors (such as rationalization processes). The purpose is to use the model as a tool for breaking down the distinct perceptual, behavioral, and institutional steps that would have to occur for the context of rising inequality to result in greater redistribution, thereby illuminating why this outcome so rarely occurs.

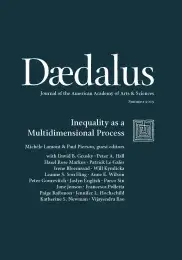

We present three models of reactions to income inequality. In Figure 1, we depict the processes explicitly hypothesized by the MRM.5 In this model, as objective levels of income inequality increase within a nation, the median voter will prefer greater redistribution (path 1). Preferences for redistribution are expected to result in more support for the candidate promising redistribution (path 2). Finally, this public support is expected to result in the implementation of policies supporting greater redistribution (path 3); that is, public policy will be responsive to public opinion. Consequently, equilibrium is predicted: as macrolevel income inequality increases, there will be greater macrolevel redistribution (path 4). However, evidence reveals that increases in income inequality are only rarely linked to greater redistribution, and often predict declining generosity of the welfare state instead. To understand why the MRM is so often empirically refuted, we must consider each of the steps in the model and interrogate the social-psychological processes underlying each assumption.6

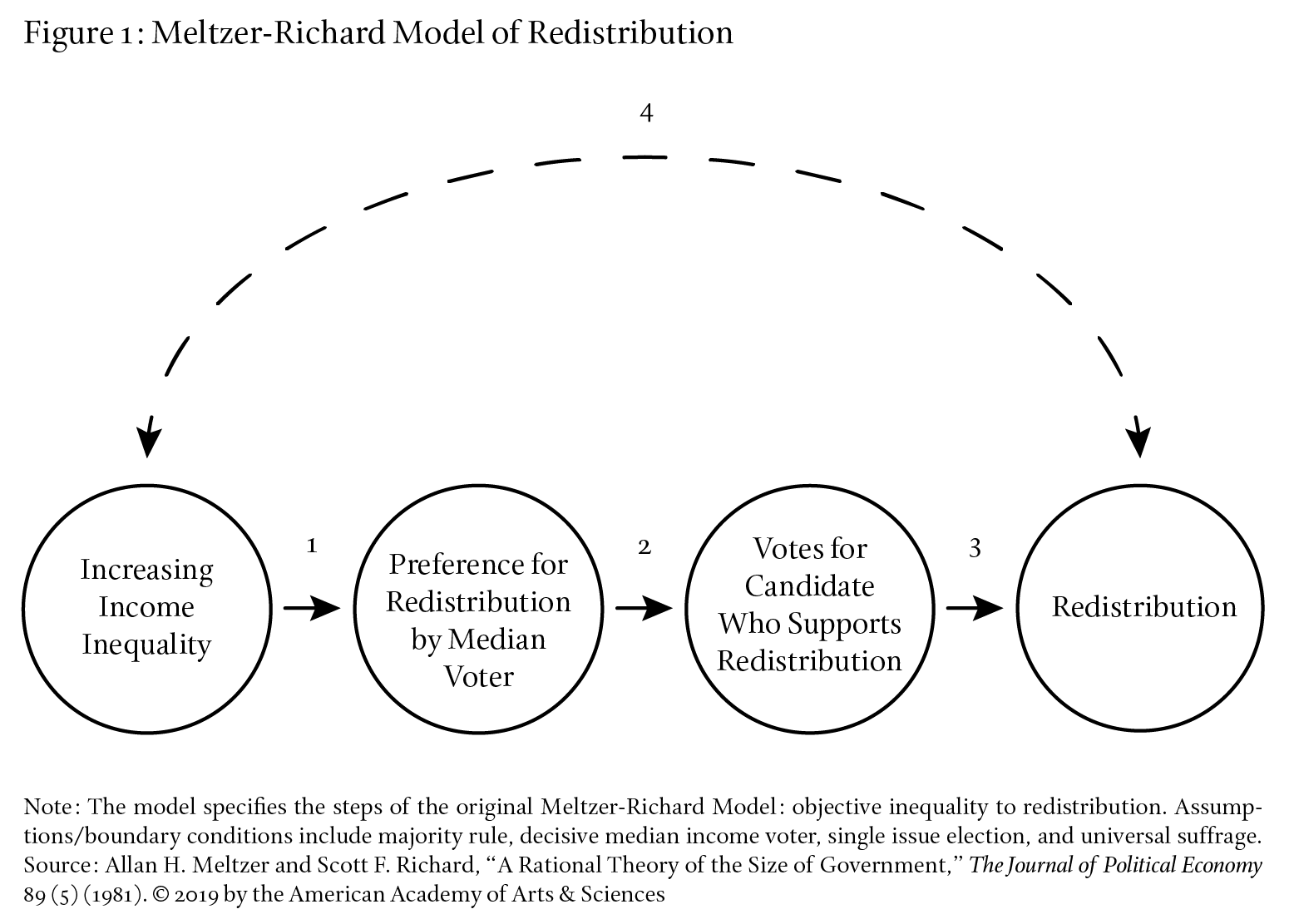

In Figure 2, we provide an Extended MRM, which makes explicit those implied microlevel processes intervening between macrolevel income inequality and preference for redistribution by the median voter. The top row outlines the MRM. The shaded circles and paths A, B, C, D, and E outline what we add to the model by unpacking potential psychological mechanisms at work. Here, the MRM implicitly assumes a positive path A: as objective income inequality increases, people will accurately perceive more inequality. In contrast, we propose that due to socioeconomic residential and work segregation, and to social comparative, informational, and motivational factors, path A will in fact be weak or nonsignificant. The MRM implicitly assumes a negative path B: as people subjectively perceive more income inequality, they will evaluate it less positively. We propose instead that the heightened inequalities people do perceive will often be rationalized and justified due to processes of legitimization. Thus, we expect a positive path B: those who perceive more inequality may evaluate inequality more favorably. Path C depicts how people’s evaluations of inequality are related to their preference for redistributive policies. The MRM implicitly assumes that path C is negative: people who judge inequalities more unfavorably should support more redistribution by the government. However, we propose that even if people believe that there is too much income inequality, they may not believe that redistribution by the government is appropriate, effective, or fair. Thus, path C may be weak. We also note path D and E in Figure 2: some research we reviewed examines the link (path D) between objective inequality and evaluations of inequality (without measuring subjective perceptions of inequality), or the link (path E) between perceived inequality and redistribution demand (without measuring evaluations of inequality). We suggest that these paths are likely mediated through the variables we identify in Figure 2 and, because of the processes outlined above, are likely to be weak. Of course, for each of these paths, significant individual differences in beliefs about and attitudes toward inequality can feed into and/or moderate these processes. Therefore, we discuss for whom these effects are more or less likely.

Paths 2 and 3 of the Extended MRM again depict how greater preference for redistribution leads to more support for the candidate promising redistribution, which translates to actual redistribution. We denote these circles in the model with dotted (rather than solid) lines. We consider this process, but in relatively less depth due to our focus on the social-psychological processes that disrupt the explicit and implicit assumptions of the MRM. We assert that although paths 2 and 3 from public opinion to votes to policy are assumed to be positive, these links are likely attenuated or disrupted by a variety of political processes that are themselves affected by levels of income inequality.

In Figure 3, we depict how macro-, meso-, and microlevel factors can affect, moderate, or be influenced by the processes by which people respond to increasing inequality (see the inner lighter circle). First, macro-, meso-, and micro-level factors may act as antecedents of elements in the inequality model. For instance, macrolevel cultural narratives and myths about meritocracy or poverty can affect people’s preference for redistribution. Second, macro-, meso-, and microlevel factors may moderate the processes or paths within the model. For instance, the strength of the relation between objective income inequality and people’s perceptions of such inequality may depend on the mesolevel spatial segregation that exists along socioeconomic status (SES) lines. Third, the processes whereby people experience and respond to income inequality can also affect broader macro-, meso-, and microlevel factors. For instance, the rationalization of inequality can lead to prejudice toward the poor and more conflictual intergroup relations: examples of consequences that extend beyond public support for redistribution itself.

As inequality rises, broader contextual and social-psychological processes will impede the likelihood of people correctly recognizing high inequality, evaluating it as extreme, and supporting greater redistribution. A critical point of our essay is to articulate the conditions that result in blindness to, legitimization of, and reproduction of inequality, thereby allowing us to consider how to facilitate the conditions that could result in less, rather than more, inequality. To begin, let us consider the most basic test of the MRM: do systems and people act to maintain some equilibrium between inequality and redistribution over time?

Meltzer and Richard offer a self-correcting model of how democracies keep inequalities in check: when inequality rises too much, voters mobilize to demand better balance. The model has been tested in a variety of ways. The first component always represents objective income inequality operationalized with measures such as the Gini index. Some studies examine how inequality leads to demand for redistribution (public opinion); other studies assess actual redistribution (redistributive policies, social spending). There is good reason to presume that demand for redistribution will not always map onto actual redistributive policy.7

Redistributive policies can take various forms, including new tax rates, welfare support, social security, public health care, public education, unemployment insurance, and old-age pensions. Whereas some policies are more directly redistributive (like welfare), others can be categorized as social safety nets (like unemployment or pensions) or as public goods fostering equality of opportunity (like public education).8 Although different types of redistribution may be viewed quite differently by the public, here they are all treated as metrics of the same overarching construct of redistribution.

According to the MRM, as levels of income inequality increase, so should demand for redistribution (see Figure 1, path 1) and actual redistribution (path 4). In general, support for path 4 – objective inequality leading to more redistributive policies or actual redistribution – is mixed. Some analyses find support or mixed support, others find no relationship.9 Indeed, some researchers find the opposite pattern: in both crossnational and longitudinal studies, greater objective inequality sometimes predicts lower levels of redistribution.10

Does rising inequality prompt the hypothesized demand for redistribution, even if not always translated to policy? Support for path 1 is also inconsistent: Some analyses suggest that high inequality increases demand for redistribution; other studies link higher inequality to lower support for redistribution, across countries or within-country across time.11 For instance, as income inequality rose over twenty-five years in the United Kingdom beginning in the mid-1980s, public support for redistribution fell.12 Other studies examining multiple nations find no consistent relation between objective inequality and public demand for redistribution.13 Given the mixed evidence, we conclude that the MRM’s hypothesized positive links between inequality and redistribution (Figure 1, paths 1 and 4) appear to be largely unsupported.

A related body of research, however, demonstrates that although actual inequality fails to predict support for redistribution, higher perceived levels of inequality are sometimes linked to both greater demand for redistribution (Figure 2, path E), and more generous redistributive policy.14 It makes sense that public opinion would be shaped more by the inequality people perceive than by what goes unnoticed; these findings point to a meaningful disconnect between actual and perceived inequality levels (Figure 2, path A). How accurate are people’s judgments of income inequality?

Implicit in the MRM is the assumption that people estimate with reasonable accuracy the level of inequality in a society at any given time (Figure 2, path A). However, there is good reason to doubt that people’s subjective perceptions correctly track objective levels of income inequality. Psychological mechanisms may inhibit the detection of true levels of inequality; paradoxically, estimates may become more inaccurate as actual inequality levels rise. Across forty countries, people were quite poor at guessing their nation’s pattern of wealth distribution: in only five of forty countries were estimates correct more than 50 percent of the time.15 Furthermore, people seem to be limited in their ability to track large-scale changes in inequality over time. Although income inequality rose dramatically in the United States between 1980 and 2000, one-quarter of Americans reported being unaware of any change.16 Likewise, longitudinal, multinational studies have revealed at times no link between objective levels of inequality and perceptions of inequality and, at other times, only a small association, leaving considerable room for slippage.17

Knowing that people incorrectly estimate levels of inequality does not tell us whether their perceptions are under- or overestimates. Evidence is mixed, but most frequently, people’s misperceptions of inequality err in the direction of underestimation. For example, Americans estimated that the richest quintile owned 59 percent of the wealth, while the bottom two quintiles combined controlled roughly 10 percent; in fact, the richest quintile controls 84 percent of the wealth and the bottom two quintiles – the bottom 40 percent of Americans – control 0 percent.18 The phenomenon seems to be driven especially by underestimation of the staggering incomes and wealth controlled at the top, as well as dramatic underestimation of the economic disadvantage still faced by minority groups such as Black Americans.19 This underestimation is not a uniquely American phenomenon; it has been demonstrated internationally, with the most pronounced underestimations in countries with the highest levels of actual inequality.20 Underestimation is significant because people who do perceive higher levels of inequality tend to report greater support for redistribution (Figure 2, path E).21

Although misperceptions often underestimate inequality, any bias that sometimes veers in one direction can conceivably also lean in the opposite direction. Accordingly, evidence suggests that although respondents from many nations tended to underestimate inequality on average, respondents from some nations were fairly accurate and others tended to overestimate true levels of inequality.22 Political leaning may also play a role: in one recent study, American political liberals were more likely than conservatives to overestimate rising inequality.23 Taken together, the available evidence suggests that people’s ability to track real levels of inequality is tenuous at best, often underestimated, sometimes overestimated, and can be affected by how the question is asked and by preexisting ideologies.

What affects people’s perceptions of inequality levels? People do not form their impressions of inequality levels after poring over years of data; they rely on cognitive shortcuts and highly accessible information.24 It is important therefore to understand the micro-, meso-, and macro-level contextual factors (Figure 3) that can shape perceptions of inequality and contribute to the disconnect between objective and perceived levels of inequality.

First, media portrayals of income inequality may be a macrolevel contextual factor that weakens the link between objective income inequality and its accurate recognition (Figure 3). People rely on the media to make sense of complex issues when information is otherwise not available to them, and media coverage can affect people’s beliefs and positions on economic issues.25 Awareness of levels of inequality could rise during periods of increased coverage (such as during Occupy Wall Street). However, mainstream media provide incomplete information about economic issues, such as the implications of the Bush 2001 and 2003 tax cuts for income inequality.26 Further, news coverage does not necessarily track actual economic trends.27 In the United States, as inequality rose between 1980 and 2000, print media reporting on this issue declined.28 Media and political narratives may be crafted by economic and political elites to shape public opinion.29 Under conditions of greater inequality, economic elites have an even larger share of control over these forms of influence, along with a heightened incentive to discourage unwelcome scrutiny.30

Second, there are mesolevel or socially contextualized ways in which people access media – and more recently social media – that could influence how people perceive income inequality (Figure 3). People may choose partisan media and curate social media networks that create informational echo chambers limiting exposure both to ideas inconsistent with their ideology and to people dissimilar from them.31 Such informational echo chambers are increasingly intensified by online algorithms selectively providing attitude-consistent stimuli and undercut the likelihood that people will receive accurate information about inequality.32

It is also worth acknowledging differential access to institutional sources of knowledge other than media. People do not experience “inequality levels” directly via lived experience; rather, they experience levels of economic hardship relative to those in their local environment. People’s awareness of actual levels of inequality may be contingent on formal education and access to and ability to critically evaluate aggregate evidence. As rising inequality compounds educational disparities, access to detailed aggregate information about economic inequality might increasingly become available mainly to the wealthy.33

Third, accurate perceptions of inequality may be inhibited by mesolevel factors, such as spatial segregation based on SES (Figure 3). Because people tend to cluster in socioeconomically homogenous rural/urban milieus, neighborhoods, and social networks, they may have little first-hand knowledge of “how the other half lives.”34 This tendency toward residential segregation on the basis of income has become increasingly pronounced as inequality has risen, especially for black families.35 Hence, rising inequalities can paradoxically shield people from recognizing the full extent of the economic gap. Residential and spatial segregation limit awareness of the true range of economic circumstances in broader society; at the same time, it further perpetuates inequality over time via access to resources, education, jobs, and mates.36

Fourth, at a microlevel, social comparison processes work in tandem with increasing residential segregation to disrupt accurate comparative assessments of inequality (Figure 3). Because social comparisons are predominantly made with relevant, close others, people may limit comparisons to people in their (increasingly) income-segregated networks. As a result, comparisons may fail to gauge real levels of societal inequality and may dampen dissatisfaction with one’s rank.37 By comparing themselves with economically similar others, the poor overestimate their societal-level SES and the rich underestimate theirs, contributing to underestimations of overall inequality in both cases.38

Fifth, at the level of culture, people may limit the economic information that is visible, displayed, or willingly shared. Open talk of money and wealth can be taboo, especially among the wealthy.39 Further, aware that mounting resentment of the rich can have unwelcome consequences for them, elites may avoid full disclosure out of self-interest (which is also reflected in their opposition to formal pay-ratio disclosures such as in Dodd-Frank). The likelihood of actively hiding assets to evade taxes and scrutiny rises sharply with people’s wealth.40 If people base their judgments on what they can observe (such as conspicuous consumption patterns), they may underestimate the wealth of the rich, who spend far less of their available money.41 Conversely, talk of debt may be uncomfortable or embarrassing for the disadvantaged, rendering it invisible and subject to pluralistic ignorance. In addition, low-income people often use credit to access consumption goods they could otherwise not afford (obscuring their genuine level of disadvantage). Middle-class households, too, may incur considerable debt to meet local standards or gain entry into good neighborhoods and schools.42 Because the rich may hide their wealth while the poor hide their debt, the extent of income inequality is further masked.

The MRM contends that rising objective inequality will increase demand for redistribution. A key (implicit) assumption of this model is that people’s subjective perceptions of inequality accurately track its reality (path A). Evidence overwhelmingly fails to support this assumption. We offer a multilevel account for the disconnect between actual and perceived inequality, and argue that subjective estimates may become increasingly inaccurate as inequality rises.

The Extended MRM (Figure 2) suggests that as objective levels of income inequality increase, people should come to judge the level of inequality more harshly (a negative path D). However, repeated studies of crossnational differences reveal no relation between actual levels of income inequality and people’s belief that income differences are too large.43 This nonsignificant path D may be a consequence of the disconnect between objective and subjectively perceived inequality. People will not decry inequalities that they fail to perceive. But when people do subjectively perceive heightened levels of inequality, does it predict more negative evaluations of the disparity?

The Extended MRM in Figure 2 suggests that when people perceive increased income inequality, they should come to evaluate it more disapprovingly (an inverse path B). This relationship has been tested in numerous studies; however, findings are complicated because “evaluations of inequality” can be conceptualized and tested in multiple ways that reveal different patterns of findings. We summarize two central patterns that at first blush appear contradictory, but that can both be understood as psychological responses to rising inequality. First, research shows that when people are asked whether levels of inequality are “too large,” they often indicate that high inequality is indeed excessive. This pattern suggests a negative path B (higher perceived inequality leads to lower approval). But a second pattern emerges when people are asked to estimate how much inequality exists (their descriptive beliefs) and indicate how much inequality should exist (their prescriptive beliefs). Measured this way, a positive path B emerges: the more inequality people believe there is, the more they believe there ought to be. We suggest that these different patterns are not simply a methodological artifact. Rather, these distinct patterns each provide critical information about how people respond to inequality and how these evaluations change over time.

First, in cross-sectional studies in which people were asked whether income inequalities in their nation were “too large,” evidence has been generally consistent with the Extended MRM. Perceptions of greater income inequality predict less positive evaluations of income inequality. In these studies, inequality evaluations are typically conceptualized as the belief that income inequality in their nation is “too large.” Ample evidence points to people’s disapproval of high inequality. In a study of thirty countries (from 1999 to 2000), 45 percent of respondents strongly agreed that income differences were too large.44 Subjective perceptions of higher inequality predicted judgments of “too much” inequality across twenty-three countries.45 American participants who learned how much inequality had risen expressed stronger beliefs that levels were too large, unnecessary, and chiefly beneficial to the rich.46

We propose that those who evaluate income inequalities as too great do so because they view the disparity as unjust. High levels of income inequality may be seen as violating the distributive justice principle of equity.47 The equity principle states that fair allocation of outcome (pay, rewards) should be based on inputs (that is, by merit: effort, skill).48 If some people are rewarded far more handsomely for their inputs than others, this equity violation should result in disapproval of the disparity. Supporting this justice-violation view, people are more likely to see income inequalities as too large if they believe that nepotism and intergenerational advantage (as opposed to merit) determine outcomes in life.49

People vary in the degree to which they care about equity. People who believe more strongly that outcomes ought to be distributed on the basis of merit are more apt to oppose exceedingly high inequality. In our own recent research, we found that those who believed more strongly that outcomes should be merit-based reported greater disapproval of very high CEO-worker wage gaps because the excessive disparity violated equity principles.50

Together, evidence supports the contention that, at a single point in time, people who perceive more income inequality will evaluate that inequality as too large because the disparity violates equity. However, these patterns reflect what occurs in a snapshot in time, when people face the inequality before them. What happens over time, as people process and understand the income inequalities they perceive around them?

As noted earlier, although one pattern of evidence reveals that people who perceive higher inequality judge it as too large, a second pattern shows that the more inequality people believe there is, the more they think there ought to be. Before exploring that second pattern, let’s consider the relation between these conceptualizations.

For people to judge income disparities as too large, they must have made two appraisals: what level of inequality they believe to exist, and what level they believe to be ideal. If the actual level of inequality far outstrips the ideal, they are likely to judge inequality as excessive. Supporting this view, respondents in multiple countries who perceived a greater gap between what the wage gap is and what it should be more strongly agreed that income differences in their country were too large.51 What, then, predicts people’s judgments of how much income inequality ideally ought to exist?

A remarkably strong predictor of people’s ideal levels of income inequality is their perceptions of actual inequality (now suggesting a positive path B). The greater a wage gap between low and high occupational wage earners that people perceive to exist, the greater a wage gap they believe should exist.52 In one study of twenty-seven countries, fully 78 percent of the variance in people’s beliefs about how big the wage gap should be was explained by their perceptions of the actual wage gap.53

This pattern is not simply an artifact of similarly worded questions asked contemporaneously. Longitudinal studies reveal that over time, people come to believe that growing inequalities are legitimate.54 For instance, as levels of inequality increased in the United States from 1987 to 1999, people’s judgments of appropriate wage gaps widened.55 An international longitudinal study found that increases in perceived levels of income inequality mediated judgments of preferred disparity, especially during rapid political and economic change.56 Moreover, when people are experimentally exposed to higher levels of income inequality (versus a no-information control condition), the level of disparity they judge as legitimate increases.57 Across these many contexts, the more inequality people think there is, the more inequality they believe there should be.

Putting these pieces together, we propose that the relation between perceiving greater income inequality and judging inequality as excessive flips, depending on whether we are considering a cross-sectional perspective (differences between people at any point in time) or a processual perspective (differences over time). On one hand, people who perceive more income inequality to exist will, all else being equal, judge those inequalities as excessive compared with those who see less inequality. On the other hand, as people come to experience greater and greater levels of inequality over time, they will come to view higher levels of income inequality as increasingly appropriate and even desirable.

How can it be that, despite sensitivity to equity violations discussed previously, people can witness spiraling income inequality and judge it to be good? This may be due to a general psychological tendency for people to believe that what is (the status quo) is what ought to be.58 Two theories describe people’s powerful motivations to legitimize injustice (including excessive income inequality): “belief in a just world” and “system justification theory.”

Belief in a just world. First, people are motivated to believe that the world is a fair place in which good things happen to good people and bad things happen to bad people.59 This conviction can lead to the legitimization of income inequalities. This motive is heightened when confront-ed with more threatening injustices.60 For instance, American income inequality from 1973 to 2006 rose in tandem with belief in a just world.61 Individual differences in this belief matter too: people with a stronger belief in a just world evaluate income inequality more favorably when they learn a big income gap exists.62 Overall, when faced with evidence of unjustly high income inequality, people’s desire to see the world as a fair place can motivate them to believe that vast economic disparities are deserved and appropriate.

System justification theory. Second, and similarly, the motivation to uphold the status quo and therefore to rationalize its institutions could lead to the legitimization of income inequality. According to system justification theory, when people are faced with their own illegitimate low status and their personal lack of action to correct it, they either live with uncomfortable cognitive dissonance or they rationalize the inequalities as fair to alleviate discomfort.63 This view contends that people are motivated to legitimize income inequality, even when it conflicts with self-interest, because of its palliative function.64 In countries with higher levels of objective income inequality, people more strongly endorse system-justifying statements like “In general, I find society to be fair.”65 Thus, as people face rising income inequality, they may become increasingly motivated to rationalize it as justified.

How do people justify a system with high inequality? Inequality can be excused by drawing on legitimizing ideas about how such inequalities emerge and what their consequences are.66 Key ideologies that provide seemingly legitimate reasons for inequality include 1) beliefs that society is meritocratic; 2) beliefs in social mobility; and 3) beliefs in the market system.

Meritocracy beliefs. First, the belief that outcomes currently are distributed on the basis of merit (not to be confused with the justice principle that outcomes ought to be distributed by merit) predicts acceptance of income inequality. The belief (however unwarranted) that society is currently a meritocracy serves to legitimize inequalities because those at the top are seen as deserving of their better outcomes and those at the bottom are seen as underserving.67 The more people believe that outcomes are rewarded on the basis of ability and hard work, the more they accept income disparity as acceptable and even as necessary.68 Notably, crossnational evidence shows that people endorse stronger meritocracy beliefs as income inequalities rise over time.69

Social mobility beliefs. The belief that social mobility is possible can also justify rising income inequality. The notion that people, through their own hard work, can rise through the ranks to a status higher than their parents can be comforting and empowering. People who more strongly endorse the possibility of social mobility view income inequality as more desirable.70 Further, when Americans were experimentally induced to believe that there is greater social mobility, they reported greater tolerance for income inequality in their country.71

Market system beliefs. Third, ideologies concerning how markets operate can also serve to legitimize inequality. If people believe that incentives and competition are necessary to motivate hard work, and that large income inequalities have positive economic consequences, such as spurring economic prosperity, they evaluate larger wage gaps as desirable.72 Further, in new market democracies in Central and Eastern Europe, the more people believe that the market economy improves the standard of living for ordinary people, the less they evaluate current social inequalities in their country as too large.73

Although it may be the case that, at any single point in time, people who perceive greater income inequality will be more apt to judge it as excessive; over time, we have little reason to expect a negative evaluation of objective or perceived inequality as suggested by the Extended MRM. Instead, due to a desire to see the world as fair and one’s system as legitimate, people are likely to justify growing inequalities as meritocratic, aiding social mobility, and creating competitive markets. Consequently, over time, it becomes increasingly more likely that people will judge the income inequalities they see as warranted and acceptable (a positive path B). However, the proposed positive link between inequality and its evaluation is qualified by several factors. As we will discuss, people do not always correctly perceive income inequalities as they grow. Further, in some cultural and economic contexts, it should be harder or easier to legitimize income inequality; some people will be chronically more likely to legitimize inequalities than others.

What affects people’s evaluations of inequality? Our Multilevel Model (Figure 3) explores these factors. First, how people respond to inequality should be affected by broad macrolevel factors, such as cultural scripts. There are large crossnational differences in ideas about meritocracy. For instance, a greater percentage of Americans, compared with Europeans, believe that hard work pays off in the long run.74 The more consensually people within a country endorse ideologies of meritocracy, social mobility, and the market system, the more individuals accept high levels of inequality.75

Second, macrolevel economic factors are likely to condition people’s responses to income inequality. For instance, in nations that are less prosperous (as measured by GDP) or that have low social mobility, people are more likely to evaluate levels of income inequality in their countries as too large.76

Third, a society’s economic system may predict attitudes toward income inequality. Specifically, between 1987 and 1992, as post-Communist Central and Eastern European countries transitioned into free-market systems, their residents increasingly desired greater wage gaps between skilled and unskilled workers.77 However, countries that had more successfully transitioned to a market economy (such as East Germany, the Czech Republic, and Germany) showed more acceptance of inequality than countries with less successful transitions (Russia and Bulgaria).78 These data suggest that tendencies to legitimize inequalities will be constrained by macrolevel conditions: when one’s sociopolitical and economic reality is too dysfunctional, disruptive, or despairing, people are less likely to legitimize it.79

Fourth, our Multilevel Model takes demographic and individual difference variables into account. For instance, consistent with our model, people who personally have higher income or status tend to prefer a higher level of wage inequality than less advantaged respondents.80 Chronic personality differences matter, too. For instance, people high in social dominance orientation (a sociopolitical ideology that purports that inequalities between groups are natural and desirable) perceive less inequality to exist between the rich and the poor and are more accepting of greater wage gaps between CEOs and bottom line workers.81 Finally, we theorize that these processes should depend on people’s political orientation. International surveys reveal that those who identify on the political right are less likely to judge income inequality in their nation as too great.82 Conservatives may favor income inequality in part because they more strongly endorse system justification ideologies that legitimize inequality. For instance, conservatives believe more strongly that the current system is a true meritocracy, overestimate social mobility, and assert that “economic positions are legitimate reflections of people’s achievements.”83 Internationally, greater income inequality predicts lower trust in institutions for those on the political left, whereas those on the right appear to be impervious presumably because their beliefs legitimize the system producing the disparities.84

In sum, the Extended MRM may not hold because people may fail to correctly perceive the level of inequality in the first place, or come to see higher levels of inequality as desirable. Despite the fact that people are concerned about income inequality, would prefer less of it, and may regard it as inequitable, we suggest that, over time, many are also motivated to legitimize the inequalities they see.85 Processes of legitimization should be less likely in failing political systems and where cultural narratives do not assume meritocracy, social mobility, or market ideals. Finally, people higher in SES, social dominance orientation, and right-wing political ideology should be more prone to legitimizing income inequalities.

We have considered how rising inequality sometimes leads people to judge inequality levels as excessive, and other times to legitimize the disparity. Now we consider the implications of people’s evaluations of income inequality on public demand for redistributive policies. The MRM contends that as inequality rises, support for redistribution should increase. Indirectly, this implies a negative path C of the Extended MRM (that as people judge inequality levels more unfavorably, demand for redistribution should increase). We argue that although judging inequality as excessive can increase support for redistribution, the link is likely to be weak and influenced by numerous factors that reduce the likelihood that redistribution will be seen as the right solution. For instance, people’s beliefs about how markets function, their trust in government, and harsh evaluations of the economically disadvantaged can all moderate support for redistribution.86 We also outline how redistribution beliefs are affected by macrolevel processes, such as the elites’ power to control media narratives; mesolevel processes, such as increased income-based segregation; and microlevel factors, such as personal income, personal mobility, and feelings of threat.

Does the judgment that income inequality is excessive result in demand for redistribution? Although a strong link is sometimes observed, the effects are typically weak.87 For instance, across twenty-seven European countries, participants’ belief that income inequality is excessive accounted for just 3 percent of the variance in redistribution policy support.88 Given the weak direct link, it is important to consider factors that might moderate this link: when does decrying inequality result in demand for redistribution?

Although people often would prefer a society that is less unequal than their current reality, these preferences do not readily translate into increased demand for government redistribution.89 Some of this ambivalence may be due to an incomplete understanding of how redistributive policies affect inequality.90 People may also react differently to redistributive programs perceived to increase equality of opportunity versus equality of outcome: education or health care policies, for instance, may be more popular than social support for the poor.91 Although a detailed analysis of specific redistributive policies (and how these policies are framed or perceived by the public) is beyond the scope of this essay, these variations clearly matter.92

Why might people fail to support redistribution even when they see excessive inequality? There are multiple microlevel factors that might affect support for redistribution (Figure 3). First, consistent with MRM assumptions, economic self-interest plays a role: the wealthy are less apt to demand redistribution.93 Even those who expect to become wealthier (believing themselves upwardly socially mobile) show less support for redistribution.94 In fact, the rich appear to become even less generous as inequality rises: in higher-inequality contexts, wealthy individuals adopted less generous views of redistribution due to a heightened conviction that they were entitled to their wealth.95 It may be unremarkable that the rich oppose redistribution, however there are too few very wealthy individuals for their votes to represent a majority in a democracy. More interesting to consider is why the nonrich also often fail to support redistribution.96

People may oppose redistribution (even when they believe inequality is excessive) because they believe that inequality is necessary to motivate hard work and striving.97 Internationally, there is strong support for the notion that large income disparities are necessary for a country’s prosperity.98 Although this functionalist view that inequality is needed typically predicts less disapproval toward inequality, people can simultaneously believe that large differences in income are necessary and that there is too much inequality.99 Notably, the belief that inequality is necessary for competition and prosperity dampens demand for redistribution.100

Furthermore, the more people believe in the existence of a meritocracy that rewards hard work and talent, and that enables upward social mobility, the less they support redistribution.101 In contrast, beliefs that luck and social location strongly determine outcomes is linked to both desired and actual redistribution.102 Because rising inequality may intensify people’s belief in status quo – legitimizing ideologies such as meritocracy and social mobility, mounting disparities may paradoxically dampen support for redistribution just when it is (arguably) most warranted.103

When people believe that the poor deserve their own fate, they tend to oppose redistribution. This belief is tied to the legitimizing ideologies previously described: if an individual believes the system is meritocratic and social mobility is possible, they are more likely to blame the most disadvantaged for their misfortunes. These assumptions undermine support for redistribution that benefits the disadvantaged.104 The irony is that because conditions of excessive inequality tend to amplify legitimizing beliefs, the poor may be most likely blamed for their fate under the very conditions in which they are least able to escape their disadvantage.

Further, attitudes toward the poor and support for redistribution can depend on respondents’ beliefs about the ethnoracial composition of beneficiaries of redistributive policies. In nations where a visible minority group is poor (or perceived to be poor) relative to a dominant majority, redistribution can be seen as disproportionately benefiting minorities.105 When paired with the view that the poor are lazy or undeserving of help, redistribution support wanes. Stereotypes of the disadvantaged may be exacerbated by minority status (for instance, poor Blacks are viewed as less hard-working than poor Whites).106 Thus, white voters, even those at an economic disadvantage, may vote against their own redistributive interest if they believe (typically incorrectly) that benefits will go primarily to outgroups.107 Versions of this pattern are evident internationally, and countries with a larger poor ethnoracial minority tend to have a smaller public sector, suggesting effects on actual redistribution.108 It is important to emphasize that it is not ethnoracial diversity itself that drives opposition to public goods, but the economic disparity between ethnoracial groups. When an ethnoracial minority group is poor relative to the dominant majority group, the majority opposes redistribution.

People also may not support government redistribution even when they view inequality as excessive because they do not trust government to do the job of redistribution. Increased mistrust in government reduces support for government redistributive programs in favor of private charities. Notably, rising income inequality can itself result in greater mistrust in government.109 Across twenty democratic European countries, higher levels of objective income inequality predicted lower trust in, and satisfaction with, political institutions.110 Thus, in the very context in which redistribution is needed – high income inequality – people are least likely to trust the government to do this job, which in turn can lead to a cycle of even greater inequality and further mistrust.

What affects people’s support for redistribution? Certainly, favorability toward redistribution varies across macrolevel economic factors, such as national wealth (gdp) or type of welfare regime (Figure 3).111 Public support for redistribution can also be shaped by communications from political elites (who themselves may have a disproportionate incentive to maintain the status quo, and power to influence narratives under conditions of high inequality). For instance, political scientists Jacob Hacker and Paul Pierson describe twin U.S. right-wing political strategy and rhetoric that involves first sabotaging effective governance, then decrying government as dysfunctional, exemplified in Ronald Reagan’s often-repeated quote: “the nine most terrifying words in the English language are: ‘I’m from the government, and I’m here to help.’”112 To the extent that fostering mistrust in government fuels opposition to redistribution, this may well be an effective strategy for antitaxation elites.113 Intergroup hostilities can also be ignited top-down by powerful communicators, divisions further fueled by the anxiety of rising economic inequality. For example, politicians can strategically shift support away from redistribution (and even toward policies that overbenefit the wealthy) by not only drawing on existing outgroup prejudice (for instance, toward poor ethnoracial minorities), but also by actively fostering racial resentments and contributing to the creation of new animosities.114 Political and economic elites may focus blame on powerless minorities to shift scrutiny away from their own role in perpetuating economic hardship.

Earlier we noted that the mesolevel process of SES-based segregation likely inhibits accurate perceptions of inequality. We also contend that residential and workplace segregation likely reduces support for redistribution, both due to underestimations of inequality and to an inflated belief that differences are merit-based. People are increasingly only exposed to others of a similar income bracket at work. Infrequent contact with those of disparate incomes may constrain social comparisons to limited networks in which meritocracy appears to work relatively fairly (such as more competent and hardworking people getting promoted).115 This may lead to the erroneous belief that meritocracy works at a societal level too, even though the range of incomes they see within their workplace is but a small fraction of the wage discrepancies that exist within society. Likewise, income-based residential segregation may contribute to the illusion that merit is linked to mobility within narrow social contexts. Further, by limiting social comparisons to economically similar others, even the relatively wealthy may feel that they need more of their income to compete in their social networks (reducing redistribution generosity).

Finally, in terms of microlevel factors, rising inequality makes social mobility (or the “American dream”) increasingly unattainable for the disadvantaged, while, at the same time, intensifying people’s belief in social mobility. This may lead to a cycle of false hope, failure, self-blame and shame, and threatened self-worth. People are particularly likely to lash out at outgroup members when their self-worth has been threatened.116 When the disadvantaged are faced with a choice between blaming themselves for failure to achieve social mobility (ostensibly due to lack of merit) and the alternative view (often provided by political elites) that undeserving minorities – via unjust government redistribution – have cut ahead of them in line, they may find scapegoating the more palatable option.117 Hence conditions of rising inequality once again provide the backdrop needed to fuel increased intergroup hostility, expressed in part through opposition to redistribution.

So far we have considered multiple factors that might lead people to either high or low support for redistribution. The MRM assumes that voters who support redistribution will also vote for it (Figures 1 and 2, path 2). Is this assumption warranted? That is, does public support for redistribution, particularly among lower-income individuals, reliably translate into votes?118 Support for redistribution translating to action may be dampened – even among those who would benefit from it – by the mesolevel political process of “policy bundling.” For instance, in the United States, the Democratic Party has come to represent racial/social progress and redistribution; the Republican Party has come to stand for racial/social conservatism and opposition to redistribution. Therefore, voters must align with the issues they prioritize most even if all of their interests are not represented. In such cases, people may vote against their own redistributive interests in order to express support for some identity or culturally relevant value.119

Further, although the Meltzer-Richard hypothesis assumes that all eligible members of a society are equally likely to vote, this is rarely the case. Asymmetry in voting patterns is well-documented: people who are lower-income, less educated, and a minority ethnicity are relatively less likely to vote.120 Moreover, lower-income voter turnout is particularly dampened under conditions of high inequality.121 Rising inequality may affect voting asymmetries by exacerbating the structural barriers to voting among lower-SES people (that is, less time, knowledge, and resources), decreasing their psychological sense of power, control, and political efficacy.122 Rising income inequality therefore begets political inequality, which in turn begets greater income inequality. These microprocesses dampening voter turnout are worsened by meso- and macrovoter suppression mechanisms that disproportionately affect lower-income and minority voters, including residence requirements, voter id laws, limited early voting, and felony disenfranchisement. All of these laws affect poor and minority voters disproportionately: for example, one in thirteen African American men are unable to vote due to (often lifetime) felony disenfranchisement. The disproportionately high arrest rates among minority and low-income groups exacerbate this disparity.123 Stifled political participation matters: support for redistributive policies is higher when voter turnout is high.124

The final link in the MRM (Figures 1 and 2, path 3) presumes a simple direct step between demand for redistribution (via voting) and actual generous, effective redistributive policies. However, the link from public opinion to policy is far from straightforward. Even when support for redistribution is high and reflected in voting patterns, policies may not be responsive to demand due to the realities of the political process, particularly in contexts of rising inequality.

First, the nature of national political institutions strongly shapes the degree to which aggregate preferences lead to responsive policy. Different institutions produce divergent policy outcomes, even holding preferences constant. The voting system (such as proportional representation versus majoritarian once-past-the-post rules, presidential versus parliamentary institutions, federalism, two-party versus multiparty systems) meaningfully impacts this relation (path 3). Further, gerrymandering alters the outcomes of an election as district boundaries are strategically redrawn to concentrate a particular party or group in some districts and weaken its numbers in other districts, thereby diluting representation of some groups relative to others. Thus, not all preferences are weighed equally in election outcomes.

Further, although the democratic ideal assumes each person’s preference is weighed equally in determining outcomes, reality often diverges. Not all people’s preferences matter equally to political decision-makers. The public opinions voiced by high-income voters are more likely to hold sway among politicians than the opinions of middle- or low-income voters, particularly for economic (versus social) policy.125 How does this happen? First, higher-income voters engage in more political action, including donating to political candidates, and as such, the wealthy exert more influence on who runs for office and whose concerns are heard.126 Here again, institutions play a key role in the disconnect between preference and policy. On one hand, the interests of the affluent are likely to align with many lobbyists, special interest groups, and political action committees, which have increased dramatically in number and influence as inequality has risen; on the other hand, interest groups representing the less affluent (like unions) have declined precipitously in number and power.127

Finally, we point out a psychological side effect of the impact of institutions that fosters inequality of voice. The disadvantaged in society may correctly perceive that even when they vote or publicly express their preferences, their preferences are rarely borne out in observable policy change. This apparent lack of impact may reduce voter trust and confidence that the government can be relied upon to effect positive change.128 It may also increase feelings of powerlessness and system inescapability for the poor, which can heighten the tendency to justify the status quo and thereby reduce their support for redistribution.129 Over time, the attitudes of the poor toward redistribution follow those of the rich and become more conservative.130 However, in some circumstances, people may opt for resistance instead, attempting to dismantle the system they recognize as unfair or illegitimate.131 Disillusionment with political elites, paired with anger about economic circumstances, may lead to attempts to change an ineffective political system. Status quo – rejecting gestures like the Brexit vote, rising popularity of populist movements, and support for authoritarian leaders with disregard for democratic norms may all be responses to the perception that the system has failed the people.132 As Bill O’Reilly opined, “They want someone to blow that system to hell. That’s why Trump is winning. He pinpointed festering disenchantment long before anyone else.”133 Of course, Trump’s version of populism criticized the system and decried both corrupt elites and low-power minority groups such as undocumented immigrants and Muslims. Disillusioned voters may be swayed by different aspects of this rhetoric, with some taking aim at the powerful and others tempted to blame minority groups for their struggles. Following his election, it became evident that Trump would not act to dismantle the status quo benefiting the rich (instead exacerbating it with further tax cuts for the wealthy), but would instead be increasingly willing to follow through on scapegoating the powerless.

Although the Meltzer-Richard Model of voter behavior (assuming rational, self-interested voters consider policy implications) is common in much of the literature, the validity of this model of voter behavior is highly questionable. Indeed, social scientists Christopher Achen and Larry Bartels offer a compelling alternative account.134 Often, voter behavior is derived from ingroup identification rather than substantive policy preference. Thus, it is more likely for voters to start with their party affiliation, work backward to determine what policy positions they hold (that is, those espoused by their party leaders), and then develop post hoc rationalizations for policy support.135 Psychologists, too, have recognized that party affiliation can often override policy content, especially when it serves belongingness or identity needs.136 People may become more likely to vote against their interests economically in times of rising inequality because economic uncertainty heightens the need to belong to a tribe.137 Economic inequality has also been linked to higher political polarization, which heightens the inclination to uncritically accept ingroup views and to reject anything the opponent group prefers.138

This essay considers a nearly worldwide phenomenon: the dramatically rising levels of economic inequality. There are many reasons to imagine that in a democracy, people would perceive these trends, judge them as undesirable, and demand a strengthened welfare state via redistribution. Although public outcry in the face of such extreme gaps in income seems both warranted and intuitively plausible, evidence for it is strikingly hard to find. Indeed, there is clearer evidence that in the face of rising inequality, public transfers and various redistributive social programs often become markedly less generous.

To explore the factors that produce or hinder support for redistribution in the face of high inequality, we have used the simple and elegant logic of the MRM as a means of systematically unpacking the considerably more complex and nuanced reality.139 We show why this model’s lack of support can be understood by considering the host of psychological processes that can contribute to slippage between each of the links in Figure 2. Ultimately, we build a multilevel account for why rising and extreme inequality so often fails to prompt action.

First, does greater objective income inequality lead to greater perceptions of inequality (path A)? No. People are often inaccurate, both about the extent of inequality and their own rank in the system. The context of rising inequality contributes to the residential segregation, comparison patterns, and cultural norms that underlie this phenomenon.

Second, do perceptions of greater inequality lead people to evaluate it negatively (path B)? Although people are likely to judge high perceived levels of inequality as too large, over time, they tend to legitimize rather than revile it. Neoliberal societies are particularly rife with legitimacy-supportive ideologies (such as that markets are highly meritocratic and foster social mobility or that individuals are responsible for themselves) that justify the system.

Third, does evaluating inequality as excessive lead to support for redistribution (path C)? Surprisingly often, the answer is no. Inequality may trigger intergroup divisions that reduce willingness to reallocate to outgroup members perceived as undeserving. Rising inequality may hinder trust in the government to solve the problem, resulting in a feedback loop producing greater inequality and yet more mistrust.

Finally, we consider both psychological and institutional reasons why a preference for redistribution may still not translate into votes (especially among low-income voters), and the broader political and institutional reasons why public opinion and votes of lower- and middle-income citizens may not translate into policy (relative to policy preferences of the affluent). Each of these processes in turn exacerbates inequality, reinforcing the cycle of status quo – legitimizing perceptions and further contributing to voter disillusionment.

Our primary focus is on microprocesses: that is, the psychological reasons why rising inequality may indeed sometimes produce perceptions of rising inequality, negative evaluations of it, and a preference for redistribution, but also – in stark contrast to the expected outcry – inequality blindness, system-legitimizing responses, victim blaming, and rejection of redistribution as a solution. However, we situate those microprocesses within the context of macrolevel factors like other economic conditions and media coverage and mesolevel factors such as social networks, political institutions, and neighborhood and work segregation (Figure 3). As a result, we reveal some ways that social and psychological processes may influence groups and institutions, and also how macroforces like rising inequality foster legitimizing processes, feelings of threat, perceptions of blame, and loss of trust that have profound effects on intergroup animosities. In turn, waning feelings of trust and solidarity as a nation may deeply affect people’s faith in government contributions to the public good.

The Meltzer-Richard Model assumes a linear process from conditions of inequality to political backlash toward it to policy outcomes that correct it. Similarly, the Extended MRM and the structure of our analysis may still invoke the assumption that people consider their available evidence (however imperfect), evaluate the evidence, and make a judgment about their policy preference. In contrast, our Multilevel Model suggests that the processes at play are circular and crosscutting. As a case in point, political identification has been recognized in our analysis as a driver of perceptions and evaluations of inequality, fundamental beliefs about meritocracy and personal responsibility, rejection of redistribution, and voting behavior. More centrally, we propose that people’s perceptions of how much inequality is excessive is itself influenced by the level of inequality, which feeds on itself through cultural, social, political, and psychological processes. In other words, income inequality over time generates self-reinforcing processes and leads the disadvantaged to adopt self-defeating beliefs.

Because our main focus is to add a psychological lens to understanding reactions to income inequality, the bulk of our analysis ends with the issue of voter support for redistribution. Although we recognize that public opinion alone does not determine redistributive policies, its role is nonetheless important. Politicians and special interests spend vast sums to influence public opinion. Voters can, in some cases, contribute to dramatic change in public policy, for instance by voting for a drastic leadership change (such as populist or authoritarian leaders who eschew political conventions) or for democratic shifts such as the American New Deal, the French Popular Front, or the British Labor Party triumph of 1945.140

Further, public opinion – or more specifically, people’s beliefs about inequality – carry weight in the social world. If the context of rising inequality triggers psychological processes and motivations that lead people to blame the disadvantaged for their outcomes, to believe outcomes in the world are merit-based and anyone can achieve rags to riches, it forms the backdrop for a society of rising intergroup animosity and mistrust, more racial discrimination (if disadvantaged minorities are cast as the undeserving recipients of redistribution), more political polarization, and more social uncertainty and instability. All of these processes triggered by rising inequality may result then in societal-level increases in opposition to redistribution, which then contributes to the perpetuation and reproduction of the same cycles of inequality. However, understanding these processes may also illuminate levers for change. What can be done to intervene in these processes to reduce income inequality?

It is possible to identify points of intervention for any component or path within our Multilevel Model. We highlight just a few that specifically target psychological processes that lead people to misjudge or legitimize inequality.

First, at multiple points in our analysis we highlight the importance of SES-based segregation (residential, organizational, educational). As people’s social worlds become more homogenous because their neighborhoods and workplaces afford little opportunity to interact with those of a different income bracket, people are less able to identify where they fall in the economic hierarchy or correctly perceive the amount of income inequality that exists. People are also more apt to overestimate meritocracy and social mobility because they appear to operate effectively within their narrow social context, increasing legitimization of income inequality and reducing support for redistribution. Accordingly, we propose that interventions should broaden people’s social worlds and provide opportunities for positive intergroup contact: by creating housing developments in mixed-income neighborhoods, by supporting income-contingent affirmative action programs for elite postsecondary institutions, and by facilitating interactions among those at the top (higher earners) and bottom (lower earners) of the organizational hierarchy.141 Contact yields greater benefits when groups are of relatively equal status, when there is interdependence and shared goals, and when there is a common, valued identity, making workplaces, schools, and neighborhoods excellent contexts for cross-SES contact.142

Second, because many people tend to legitimize the systems in which they are embedded, they come to see higher levels of income inequality as increasingly desirable and necessary. Inequalities are often legitimized by appealing to deservingness and meritocracy, making redistribution appear unfair. To disrupt this cycle, emphasis should be placed on predistributive programs: policies that minimize initial levels of income inequality in the workplace by increasing the minimum wage, employee gain-sharing, increasing employee benefits, and capping CEO salaries. Rather than fighting the norms for meritocracy and competition, predistributive policies can appeal to these same valued principles. CEO salaries could be better calibrated against lower-level employees, and bonuses could be more closely tied to longer-term firm performance rather than short-term gains.

Third, for many people, the American dream casts high inequality as a motivator for social mobility when in fact excessive inequality inhibits mobility. This faulty narrative could be adapted to a new one that emphasizes the value of shared public goods.143 The ways in which redistribution policies heighten equality of opportunity and support genuine social mobility should be heralded, and social safety nets can be framed as essential components of a system aimed to provide the security necessary for people to innovate, take risks, and get ahead. Moreover, given that inequality has prompted declining trust in government, politicians – even liberal ones – have increasingly avoided highlighting the (positive) role of government and indirectly capitulated to the notion that less government is better.144 Ironically, this hesitancy to celebrate government programs may be an additional reason people undervalue the importance of public goods and redistribution: they fail to recognize the benefits they actually receive. Political scientist Susan Mettler describes how redistributive programs are often designed to be nearly invisible and hence are underappreciated by many citizens.145 This may suggest that trust in the government to manage redistribution effectively may increase to the extent that the “submerged state” is surfaced and its invisible benefits become more evident.146

In this essay, we identify how psychological factors (in concert with larger institutional- and societal-level processes) may operate to hinder the workings of effective democracy in which the interests of the few are balanced against those of the many. Most worrisome, these counterproductive processes are especially likely in the context of rising inequality in which redistribution may be most warranted. Although we articulate how these processes may trigger a self-perpetuating cycle of increasing inequality, we also illuminate some interventions that might disrupt these processes and contribute to the societal rebalance promised by a healthy democracy. Critically, these processes operate at multiple levels and target social, cultural, and economic factors. This approach underlines the value of interdisciplinary collaboration for integrating research insights and translating them into practical strategies for mitigating inequality.